Socso Rate For Foreign Worker 2021

The SOCSO EI Scheme is effective from 1 January 2019. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme.

![]()

New Update In Socso Table 2020 For Payroll System Malaysia

They are not eligible for any tax deductions not eligible for SOCSO coverage and are exempt from SOCSO contributions.

Socso rate for foreign worker 2021. How To Register Foreigner To. Effective 1 January 2019 employers who hire foreign workers shall register their employees with Social Security Organisation SOCSO and contribute to the Employment Injury Scheme under the Employees Social Security Act 1969 Act 4. Foreign workers can benefit from Socso.

This insurance regulated by the Employment Insurance System Act 2017 and also administered by the EIS SOCSO protects workers between the ages of 18 and 60 who have lost their jobs expiration of the contract. Foreign Worker Socso Rate. 02 will be paid by the employer while 02 will be deducted from the employees monthly salary.

The monthly payment of socso contribution comprising of both employees and employers share should be paid by the 15th of the month for the salary issued for the previous month. Socso calculations of socso types of protection scheme 1. On year-on-year basis the number of labour force improved by 2396 thousand persons as against the same month of the preceding year March 2020.

Melalui slip gajianda juga boleh dapatkan nombor socso. Beginning 1 January 2019 foreign workers must register with Social Security Organisation SOCSO and employers must contribute to the EI Scheme. Contribution rates are set out in the Second Schedule and subject to the rules in Section 18 of the Employment Insurance System Act.

In the first category for the most part the employer is to pay 175 of the employees total salary towards the fund and. A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act. 3 Year 2018 Translation Transfer of Foreign Workers Coverage From The Foreign Workers Compensation Scheme FWCS The Department Of Labour To SOCSO Employment Injury Scheme.

Once an employee. KWSP As you can see the contribution for foreign employees below the age of 60 stands at 9 which mirrors that of Malaysians and PRs below the age of 60. Social Protection for Foreign Worker.

Visit full article here. Socso Contribution Table 2021 for Payroll System Malaysia A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act. On Dec 8 Saravanan said Malaysia is expected to receive between 5000 and 10000 workers.

Social Security Organisation Malaysia also has a Social Security Organisation SOCSO who administers the Employment Injury Insurance Scheme. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme. Sep 12 2021 at 104 AM.

If youre still paying cheque to the socso counter you should moving it to online. Foreign workers who contribute to the Social Security Organisation Socso are eligible for benefits if they are involved in an. Contribution Payment Per Month.

For existing foreign workers in Malaysia who have valid Foreign Workers Compensation Scheme FWCS they have to be registered with SOCSO by their employers a day after the expiration of FWCS subject to the end of the cooling-off period for FWCS on 31 December 2019. Rate of Contribution Self-Employment Social Security Scheme Act 789 No. 7500 foreign worker applications pour in.

The rate of contribution is 125 of the insured monthly wages and to be paid by the employer. Foreign Employees Socso Follow Second Category Table Youtube. On January 1 2018 SOCSO introduced the EIS PERKESO portal to help employers to manage their records update and make contributions.

Rebut peluang ini untuk menerima insentif gaji RM600 sebulan sehingga 6 bulan bagi individu atau RM200 bagi setiap pengambilan pekerja dalam pekerjaan sementara atau gig. There is often much confusion around the exact amount to be paid by the employer and employee towards the SOCSO fund. As for the entry of foreign domestic helpers Saravanan said the SOP was being studied by the ministry.

How To Register Foreigner To Socso. Socso contribution rate and table. Socso announced an increase for its pension rates on 8 november 2017.

Borang Pendaftaran Pekerja Asing. Azman said some 104400 domestic workers involving 15000 workers with citizenship and permanent resident status as well as 89400 foreign workers were expected to. Both the rates of contribution are based on the total.

Employee contribution rate is based on the employees wages overtime commissions service charge annual leave emoluments sick leave maternity leave public holidays incentives. How To Foreign Workers Socso Payment Youtube. Photos from Pertubuhan Keselamatan Sosials post Permohonan bagi program KerjayaGig akan berakhir pada 31 Disember 2021.

Theres one final thing to remember. The employment income of an approved individual under the Returning Expert Programme will be taxed at the rate of 15 percent of that chargeable income. The Setemku Korporate PERKESO 2021 stamp collection album will have 10 stamps of 60sen value designed to reflect good relationship between.

Contributions to the Employment Insurance System EIS are set at 04 of the employees assumed monthly salary. How to pay socso perkeso online. 1584 million persons whereas the LFPR was unchanged at 686 per cent.

The Employment Injury EI Scheme protects employees against accidents or occupational diseases arising out of and in the course of their employment. The labour force participation rate LFPR changed little by 01 percentage point to post 686 per cent in March 2021 February 2021. Foreign workers in Malaysia are treated as nonresidents are taxed at a flat rate of 28.

However as mentioned above employers are only required to contribute RM5 regardless of how much or little the foreign employee earns. Rate of contribution for employees social security act 1969 act 4. Contribution rate is reduced to 9 for a period of 12 months from 1 January 2021.

The rate of socso contribution will depend on your salary. In simple terms there are two categories of the SOCSO fund. However in all other tax matters foreign workers are treated the same as the resident workers.

SOCSO Contribution chart.

![]()

New Update In Socso Table 2020 For Payroll System Malaysia

Social Protection For Foreign Worker

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

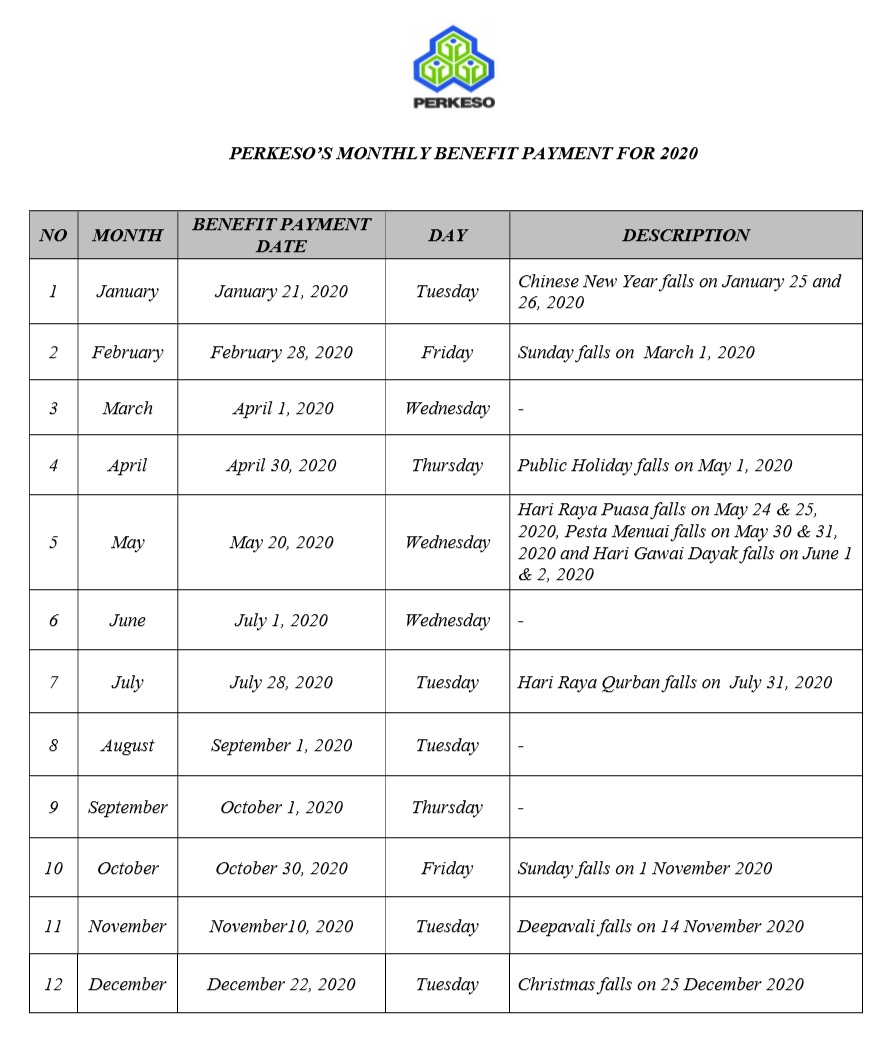

Socso S Monthly Benefit Payment

Finance Malaysia Blogspot Understanding Socso And New Rate Of Contributions Effective June 2016

Posting Komentar untuk "Socso Rate For Foreign Worker 2021"