Socso For Foreign Worker Rate

However prior approval from the Iskandar Regional Development Authority is required before a knowledge worker could enjoy the tax rate of 15 percent. The rate of contribution is capped at monthly wage ceiling of RM400000 US978.

Malaysia Will Now Take Away 20 Of Foreign Worker Salaries But Why

However under the Employers Circular No.

Socso for foreign worker rate. 02 will be paid by the employer while 02 will be deducted from the employees monthly salary. A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act. SOCSO for Foreign Workers.

3 Turn on SOCSO for this person. 3 Year 2018 issued by SOCSO recently insurance coverage of foreign workers under the Foreign Workers Compensation Scheme FWCS from the Department of Labour will be transferred to SOCSO with effect from January 1 2019. Employees exempted from.

In the Letter of successful update theres the SOCSO number of the foreign employee you newly registered. Contribution rates are capped at an assumed monthly salary of RM400000. Upon expiry of the.

However as mentioned above employers are only required to contribute RM5 regardless of how much or little the foreign employee earns. For foreign workers only employers are required to contribute to the SOCSO. Deloitte taxhand - information and insights from Deloittes tax specialists globally.

The foreign workers themselves are not required to make contributions. In the first category for the most part the employer is to pay 175 of the employees total salary towards the fund and the employee is to pay 05 of their salary amount towards the. Of Federal State Government as well as Federal State Statutory Bodies need to be registered and covered by SOCSO.

47 rows Socso Contribution Table 2021 for Payroll System Malaysia. Foreign workers are exempted from employees social security SOCSO. How is the mode of payment and contribution to SOCSO determined.

SOCSO will generate a Foreign Workers Social Security Number FWSS for every registered foreign worker. The 12-digit FWSS No. Socso Table 2019 For Payroll Malaysia Smart Touch Technology.

Employers are expected to contribute 125 of each foreign workers monthly wage to the SOCSO on a monthly basis subject to the insured wage ceiling of MYR 4000 per month. Beginning on 1 January 2019 employers who hire foreign workers not including domestic servants shall register their employees with SOCSO and contribute to the Employment Injury under the Employees Social Security Act 1969 Act 4. Both the rates of contribution are based on the total.

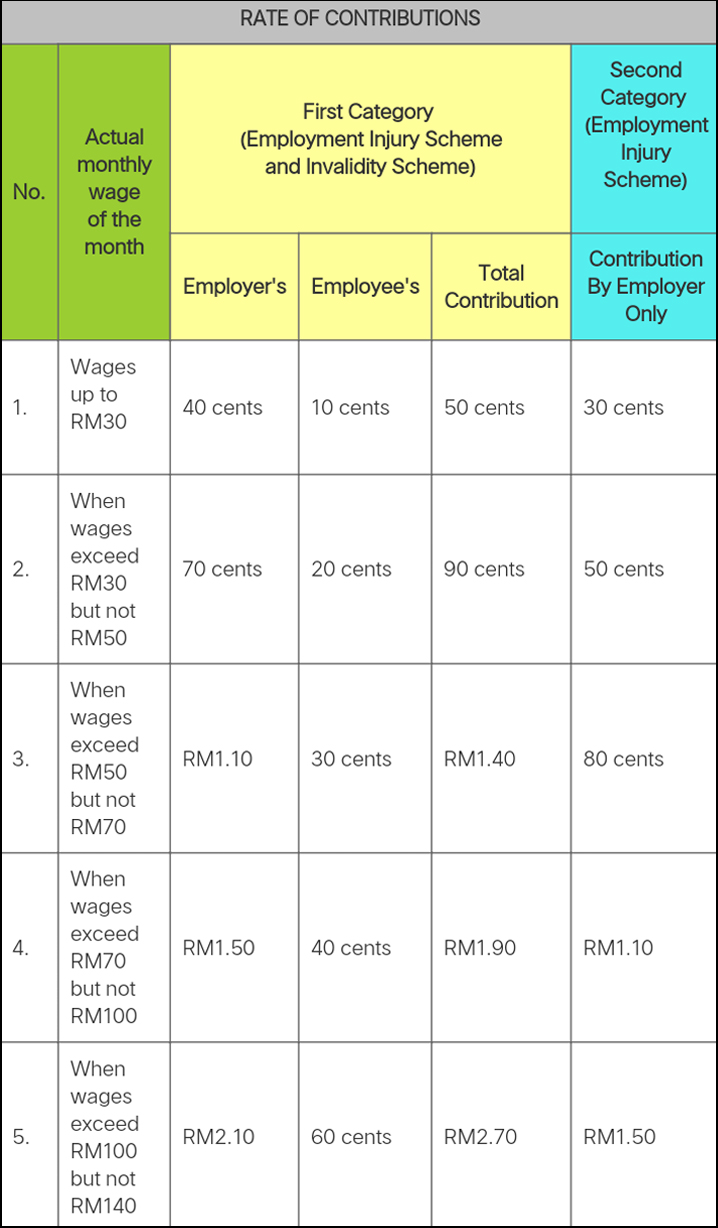

The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme. In simple terms there are two categories of the SOCSO fund. There is often much confusion around the exact amount to be paid by the employer and employee towards the SOCSO fund.

At the Payroll Calculator now you can switch on the SOCSO. Employees are not required to make a contribution. Stay up-to-date with the latest tax news rates and commentary anytime anywhere.

Contributions to the Employment Insurance System EIS Socso Table 2019 are set at 04 of the employees assumed monthly salary. All foreign workers and expatriates and their employers are exempted from statutory contributions. Shall be used when dealing with SOCSO on all issues related to foreign workers despite any changes to their details in the passportvalid working permitequivalent document in the future.

Effective 1 January 2019 employers in Malaysia who hire foreign workers including expatriates with valid documents must register their employees under Social Security Organisation Socso and contribute to the Employment Injury Scheme EIS as reported by The Star Online. Contribution Rate of EIS for Socso Table 2019 Malaysia Contributions to the Employment Insurance System EIS Socso Table 2019 are set at 04 of the employees assumed monthly salary. They can however.

Employers are required to contribute 125 percent of an employees monthly wages to SOCSO on a monthly basis subject to the insured wage ceiling of MYR 4000 per month and capped at MYR 4940. What is the contribution rate for employers and foreign workers. Rate of Contribution Self-Employment Social Security Scheme Act 789 No.

The contribution rate is 125 of the Insured monthly wages and to be paid by the employer. The rate of contribution is 125 of the insured monthly wages and to be paid by the employer only referring to the Second Category Contribution Schedule for EI Scheme only. The Cabinet has decided to place social security protection of foreign workers under Social Security Organisation.

Foreign worker socso rate. As you can see the contribution for foreign employees below the age of 60 stands at 9 which mirrors that of Malaysians and PRs below the age of 60. 02 will be paid by the employer while 02 will be deducted from the employees monthly salary.

Contribution Rates Contributions to the Employment Insurance System EIS are set at 04 of the employees assumed monthly salary. The contribution rate is 125 of the Insured monthly wages and to be paid by the employer. Contribution Payment Per Month.

Foreign workers to be covered under Socso effective Jan 1. 3 Year 2018 issued by SOCSO recently insurance coverage of foreign workers under the Foreign Workers Compensation Scheme FWCS from the Department of Labour will be transferred to SOCSO with effect from January 1 2019. Socso Employment Injury Scheme Foreign Workers In Malaysia Info News That Matter Facebook.

Upon expiry of the coverage in 2019 they will be covered under SOCSOs. For foreign workers including expatriates only employers are required to contribute to SOCSO. The Cabinets decision to place social security protection of foreign workers is in.

Contribution Rate of EIS for Socso Table 2019 Malaysia.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Employment Injury Scheme For Foreign Worker

Social Protection For Foreign Worker

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Soc Foreign Workers In Malaysia Info News That Matter Facebook

Posting Komentar untuk "Socso For Foreign Worker Rate"