Internet Subscription Tax Relief Malaysia

You can get up to RM2500 worth of tax relief for lifestyle expenses under this category. Ii Purchase of a personal computer.

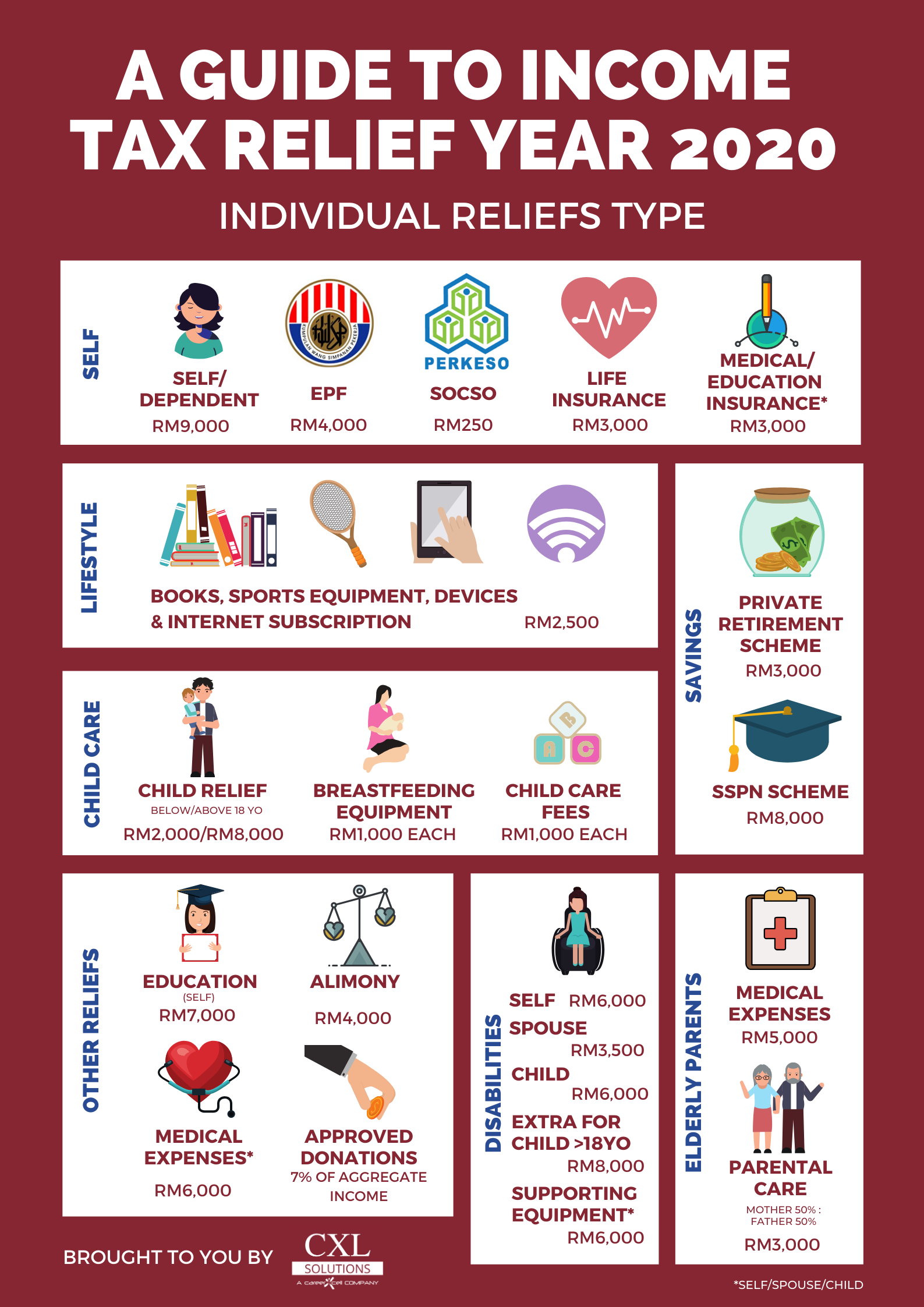

Malaysia Personal Income Tax Relief 2021

Basically theres already a RM2500 Lifestyle Relief which covers purchases of educational reading material electronic or printed electronic devices and internet subscription.

Internet subscription tax relief malaysia. And internet subscription RM3000 Expanded to include RM500 for. 2500 Purchase of breastfeeding equipment. Internet subscription paid through monthly bill registered under your own name.

Tax rebate for self If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged. Child education insurance policy Maximum RM3000 2. I Purchase of books journals magazine printed newspaper and other similar publications except banned reading materials for self spouse or child.

You can claim a tax relief of up to RM7000 if you pay for your own further education courses in a recognised higher learning institution in Malaysia. Also known as lifestyle tax relief in Malaysia this is the single persons favourite category under the topic of Personal Tax Reliefs. Yes part of lifestyle relief.

Since most people are still WFH and doing online classes the gahmen decided to extend this special tax relief if you purchased a mobile phone computer and tablet until December 2021. Purchase or subscription of books journals magazines newspaper and other similar publications in the form of hardcopy or electronic for the purpose of enhancing knowledge. Purchase of sports equipment and gym memberships and.

It clarifies that individual employee who receives benefit on using the broadband 1 registered under the name of employer and 2 the fee is paid by employer is exempted from tax. Refer to this list of the income tax relief 2020 Malaysia. Get your medical checkup and swab test for COVID-19.

Wow sounds like a lot of stuff. Subscription fees for broadband registered in the name of the individual with effect from year of assessment 2010 - 2012 500 Limited 14. Income derived from sources outside Malaysia and remitted by a resident company is exempted from tax except in the case of the banking and insurance business.

Special relief in addition to lifestyle relief for purchase of mobile phone personal computer or tablets for YA 2020 and YA 2021. I was previously made to understand by my tax agent that I would need to withhold taxes in respect of hotel accommodation and air fare expenses reimbursements made to nonresidents rendering. Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability.

Buying reading materials a personal computer smartphone or tablet or sports equipment and gym memberships for yourself spouse or child allows you to claim for tax relief. 19 rows Internet subscription. Individual taxpayers claiming tax relief or deduction must back their claims with receipts dating back seven years if they are.

The taxpayer does not claim expenses related to the medical treatment and care of parents. Relief of up to RM10000 a year for three consecutive years from the first year the interest is paid. Now this tax relief is probably one that we would use the most.

The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too. Subject to the following conditions. As of the assessment year of 2021 in this category you can claim for the purchase of.

Skim Simpanan Pendidikan Nasional. Personal Tax Reliefs in Malaysia. However with effect from year of assessment 2008 the mobile phone telephone bills and Internet subscription paid by your employer will be exempted from tax.

Under this category items that are applicable include books magazines printed newspapers purchase of personal computer smartphone or tablet buying sports equipment or gym memberships and your monthly internet subscription. Malaysia Budget 2021 - Tax snapshots Friday 6 November 2020. Further Education Fees Self.

In this article you will find the complete guide for a Malaysian on how to enjoy tax relief or tax deduction for education purposes. Interest expended to finance purchase of residential property. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability.

Payment of monthly bill for internet subscription Under own name 2500 Restricted Lifestyle Purchase of personal computer smartphone or tablet for self spouse or child and not for business use Additional deduction for purchase made within the period of 1st June 2020 to 31st December 2020. There are four areas that you can take advantage of tax relief for education purposes. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2020.

However during the work-from-home year of 2020 the government introduced a special tax relief for an additional RM2500 if you buy a computer smartphone or tablet which has been. Effective for year of assessment 2017 tax filed in 2018 the lifestyle tax relief at a limit of RM2500 yearly also includes new categories such as the purchase of printed newspapers smartphones and tablets internet subscriptions. Laptops personal computers smartphones or.

Additional relief for expenditure related to cost of purchasing sports equipment entryrental fees for sports facilities and registration fees for sports competitions. Purchase of personal computer smartphone or tablet. To claim this income tax relief the Malaysian taxpayer must fulfil all the following conditions.

The parents are the legitimate natural parents and foster parents in accordance with the law subject to a maximum of two persons. The maximum income tax relief amount for the lifestyle category is RM2500. So if you bought a computer that costs more than that you can no longer include your gym membership internet subscription and others for income tax relief.

28 rows payment of a monthly bill for internet subscription. The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills. Every time you fill in the LHDN e-Filing form youll be eligible for an automatic tax relief of RM9000.

A company or corporate whether resident or not is assessable on income ACCRUED IN OR DERIVED FROM MALAYSIA. Malaysia Inland Revenue Board IRB on 12 April 2011 issued a Technical Guideline on personal tax relief or deduction on the broadband subscription fee. Increase and expansion of existing personal tax relief Tax relief Current Proposed Medical expenses for serious diseases for self.

Companies are not entitled to reliefs and rebates. Malaysia adopts a territorial system of income taxation. Monthly internet subscriptions.

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Lhdn Irb Personal Income Tax Relief 2020

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Breaking It Down Income Tax Relief For The Year 2020 Ya 2019 Cxl

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Posting Komentar untuk "Internet Subscription Tax Relief Malaysia"