Why Malaysia Car Tax So High

With that in mind a new car does not necessarily mean high depreciation. Without competition from freely imported cars the car prices in Malaysia have rocketed sky high.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

These local manufacturers are Proton and Perodua.

Why malaysia car tax so high. For instance the total tax charges for a Toyota Vellfire could come up to about RM110000 before exemption ballooning the on-the-road price to RM382300 25L model. On 1 April 2018 I was effectively promoted by a Project Engineer to a Project Manager by my company. The highly priced import Aps were given to connected companies and individuals only.

Furthermore do note that a renewed COE Car has road tax that will increase year on year till its 50 more. The Nissan leaf is fully imported from Japan. A brand new small Toyota can have a depreciation of about 8-9k.

I dont know why the tax was so high. No statewide tax but theres a 6 sales tax due. So why are they so expensive.

4 sales tax is due. There is also a 4 sales tax. Vehicle owners must fulfil the prerequisites eg.

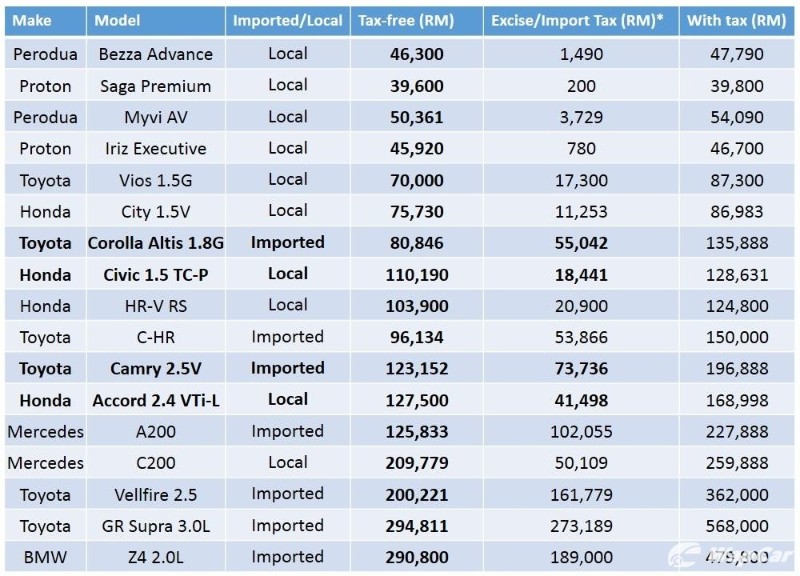

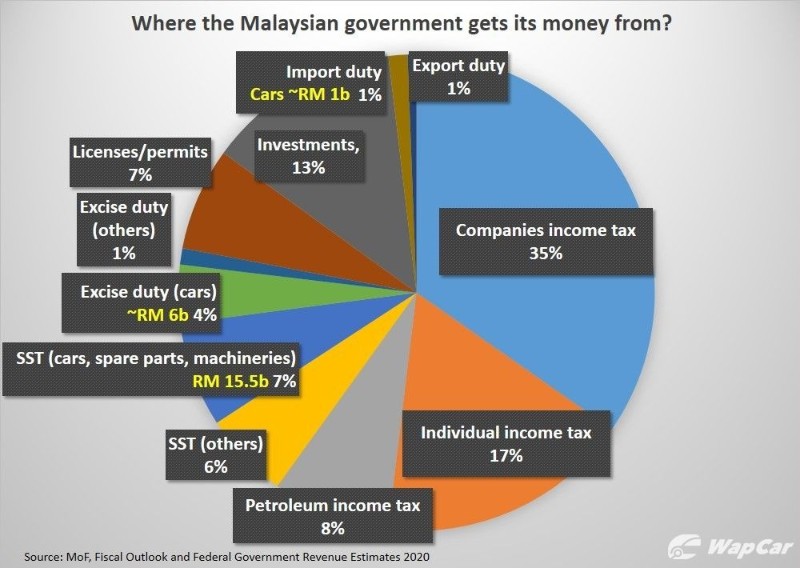

Malaysians often complain that because of high taxes they have pay some of the highest car prices in the world. Foreign imported cars are charged with a very high tax levy of 150 I think. Is it set internally within Malaysia or theres a committee of countries that sets the rate.

No statewide tax but localities may levy them. This makes most foreign cars extremely expensive for buyers although cheaper in other countries. Without competition from freely imported cars the car prices in Malaysia have rocketed sky high.

According to the new method of calculation the 110 kW Nissan Leaf road tax is calculated as such. Sales Tax All 30 0 NIL 0 NIL 10 Notes. One is withholding so I would make sure that your state taxes withheld from your paycheck show on your W-2 is correct.

However how did the taxes ended up being so high. Above 100 kW to 125 kW RM274 and RM050 for every 005 kW 50 watt increase from 100 kW. The prices are so high its causing some people to drive to Maryland to buy cheaper fuel.

According to what I see online about Hawaii GET rates it could have been about 4 or a bit more. 033 per gallon. A similarly equipped Prius sells for only around RM80000 in the US and Japan.

These taxes are also one of the highest in the world. Hans July 01 2013 1217 pm. Why would I go to a gas pump right here and pay more when I.

Prices for electricity in the UK and Europe reached record highs this week with average household bills for the month of August expected. The difference lies in the financial outlay. There is some truth in that argument.

Obtain motor insurance coverage for the new road tax renewal period pass the periodic vehicle inspection etc prior to the renewal of the vehicle road taxes. This is similar to a Toyota with renewed COE for 5 years. 1 Open Market Value OMV 2 Additional Registration Fee ARF 3 Excise Duty GST 4 Certificate of Entitlement COE 5 Vehicular Emission Scheme VES rebate or surcharge and 6 the local dealers margin.

I am working for P-Tech Sdn Bhd a manufacturer of high-quality microchips in Malaysia. This will kill the developing of Electric Vehicle so high than ICE engine ICE emitted a lot of air pollution than EV why charge Road Tax. Malaysia growth probably 80 is due to population growth so its GDP per capita will marginally increase.

Any chances of the taxes going down or becoming a rebate in income tax like purchasing a new PC. When eBay starts collecting MF tax they disable the former sales tax table for sellers that were using it. Nah China GDP growth is commendable ard 61-67 and note China very low birth rate which means 85 of growth is labor productivity growth.

The government has decided to extend the new vehicle sales tax exemption period to June 30 2021 which sees a 100 sales tax exemption for new CKD cars and 50 for CBU cars. In this case it would be on the imported car. Malaysia is rumoured to have some of the highest car prices in the world due to a costly combination of high duties and taxes levied on cars and a policy aimed at protecting the local car manufacturing industry and reducing loss.

Foreign imported cars are charged with a very high tax levy of 150 I think. If your income increased which might have put you in a higher tax bracket it could have reduced or eliminated some deductions or credits and the tax laws changing year to year will determine the amount of taxes that need to. Combined with the 10 sales tax tax charges for cars can come up to quite a substantial amount making Malaysia one of the countries with the highest tax on cars globally.

DUTIES TAXES ON MOTOR VEHICLES A PASSENGER CARS INCLUDING STATION WAGONS SPORTS CARS AND RACING CARS CBU CKD CBU CKD IMPORT DUTY IMPORT DUTY LOCAL TAXES CBU CKD CBU CKD. These excise duties imposed on foreign manufactured cars have made them very expensive for consumers in Malaysia. 048 per gallon varies by county.

The excise duty is 10 and the import duty is 0 due to the Japan-Malaysia FTA. Well explain what these costs are and how they make cars in Singapore so expensive. In addition to a bigger paycheck I was also granted a company car benefit which is Mazda CX-5 and free petrol for both business and private use.

1 Sept 2018 MALAYSIA. 3 per day plus excise tax. GDP per capita would be 11000 10620 33000 in 2042.

The highly priced import Aps were given to connected companies and individuals only. A Special Tax is levied on diesel cars and is payable in addition to the road tax of the vehicle. MFN Most Favoured Nation rate ATIGA ASEAN Trade in Goods Agreement Updated.

Heres a look at just how much excise tax you can be charged for passenger vehicles in Malaysia. Good at article right when I am looking forward to replace my aging car. The seller has nothing to do with this tax so its not a FVF conspiracy as was suggested earlier.

Excise tax is an additional tax that needs to be paid when purchases are made on a specific item or good. Take for example a Japan-made 2013 Toyota Prius which starts at RM140000 in Malaysia. It is the excise tax.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Posting Komentar untuk "Why Malaysia Car Tax So High"