Who Is Eligible For Epf Malaysia

Eligible Individual B50 Customers with loss of employment with documentary evidence OR. Serving under articles or indentures to qualify in a trade or profession in Malaysia.

Malaysia Kumpulan Wang Simpanan Pekerja Kwsp Epf Employees Provident Fund Socialprotection Org

The EPF acknowledges that members are concerned about the decisions that the EPF undertakes in managing its investments.

Who is eligible for epf malaysia. Employees can make a PF withdrawal claim on the EPFO member portal by following the steps mentioned below. Steps for EPF Withdrawal Online. As already mentioned if the employee has seeded hisher Aadhaar card details with ones UAN account they do not require the attestation of their employer to make a PF withdrawal.

Act A1300-Employees Provident Fund. 3-month interest profit waiver and reduced instalments of up to 2 years inclusive of 3-month interestprofit waiver period. Employees Provident Fund Amendment of Third Schedule Order 2003.

To ensure that risks are mitigated the EPF follows a stringent due diligence process that requires any proposal to first go through the Management Investment Committee where it will be scrutinised in accordance with our long-term. It seems that the EPF withdrawals are sought to pay debts or to start a small business. Can my will include foreign property.

Participation in EPF is mandatory for Employers who have more than 20 workers and for workers whose basic salary is more than Rs. With at least 50 loss of income with documentary evidence URUS A. Pursuing a full-time degree or equivalent including Masters or Doctorate outside Malaysia.

During the pandemic EPF withdrawals totalled RM101 billion. Also the saved amount earns interest and is also eligible for tax deduction. RM2000 per child or RM8000 per child.

Receive 5000 bonus reward points monthly. Visit the EPFO member portal. Life insurance and EPF.

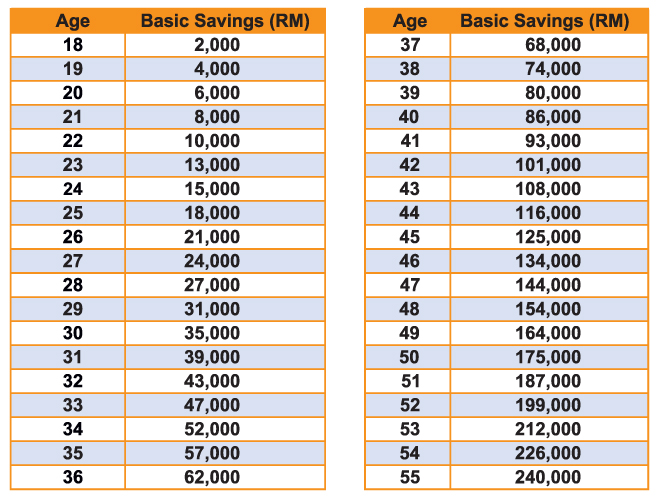

The most attractive feature about EPF is that it is risk free and could be chosen as an investment tool to be used after retirement. For most of us we know or at least heard of EPF Employees Provident Fund which is also known as KWSP Kumpulan Wang Simpanan Pekerja in the local Malay languageBecause employers and employees in Malaysia must contribute a portion of their monthly salary to EPF savings as a retirement fund. A 2272003 -Employees Provident Fund Amendment of Fifth and Sixth Schedules Order 2003.

3-month interest profit waiver only. However in circumstances where EPF has no record of your nominations your EPF contributions will be paid in accordance with your will. A 1782004-Employees Provident Fund Amendment of Third Schedule Order 2004.

This post is about EPF Self Contribution. More than six million members were left with less than RM10000 in their accounts and more than 11 million will spend their retirement in poverty. Apply for Visa Platinum Credit Card Online and earn 10x rewards points for online spends 5x rewards points on dining.

Yes your will can include with both assets within Malaysia and abroad.

Employer Contribution Of Epf Socso And Eis In Malaysia

I Lestari How To Withdraw Rm500 Month From Your Epf Account

Epf Eligible Members Can Apply For I Sinar Beginning Mid December Malaysia Malay Mail

Employees Provident Fund Malaysia Wikipedia

Posting Komentar untuk "Who Is Eligible For Epf Malaysia"