Statistics Of E-wallet Users In Malaysia 2020

Boost is another dominant player in the e-wallet market with 170000 merchants and 75 million users. 16 Smartphone penetration is at 57 percent just below Chinas 60 percent but lower than neighboring Singapores 78 percent.

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

Based on the MasterCard Impact Study 2020 we lead Southeast Asia in e-wallet use at 40 per cent take-up compared with the Philippines 36 per cent Thailand 27 per cent and Singapore 26 per cent.

Statistics of e-wallet users in malaysia 2020. French opinion on e-wallet payments 2020 by type of opinion Number of active mobile wallets in France 2012-2018 French consumers degree. GrabPay one of Malaysias leading e-wallet. In 2020 online and mobile banking penetration reached 1125 and 618 respectively and RM 460 million worth of mobile banking transactions were conducted a 125 jump compared to the previous year.

Digital wallets known as dompet digital in Malaysia are the fourth most-used payment option accounting for just seven percent of transactions. 25 to 34 years old. As of the MasterCard Impact Study 2020 we are leading Southeast Asia in electronic wallet usage with 40 of accounts being used compared.

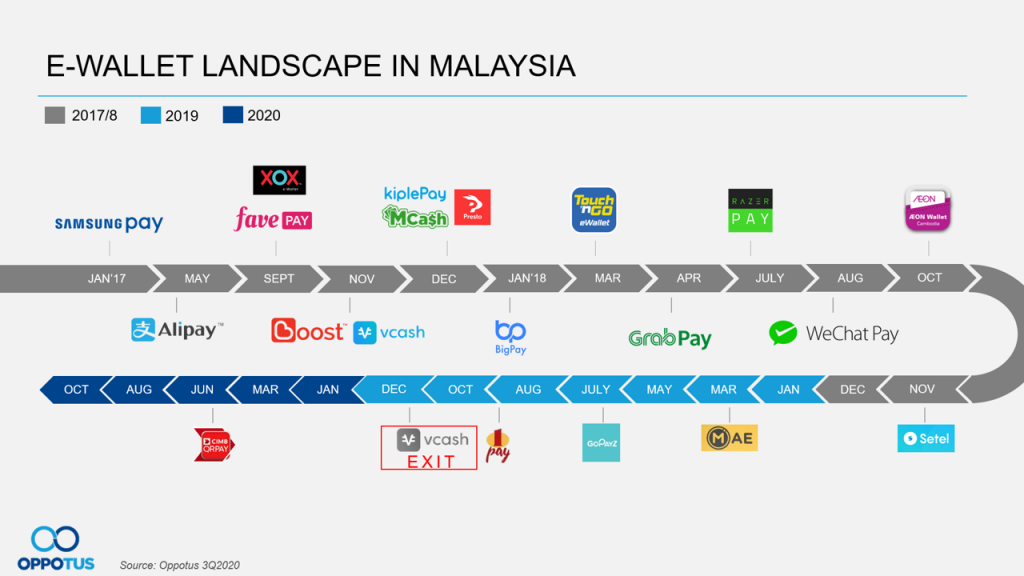

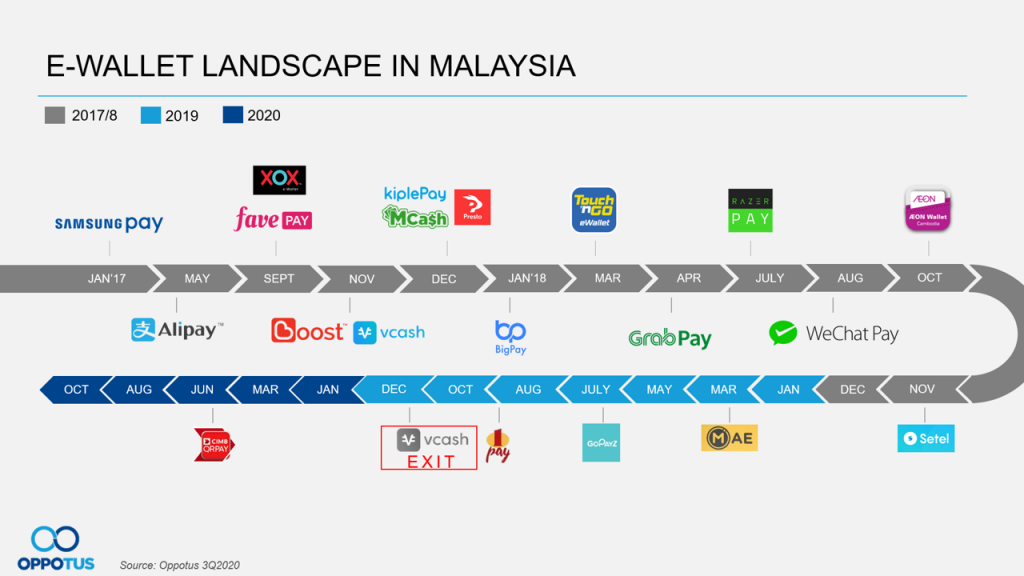

However the role of non-monetary factors in promoting the use of e-wallet remain unknown in Malaysia. The year 2020 and beyond will see the continued rise in popularity of e-wallets which stole the financial technology limelight in 2019. Find the list of all eWallet available in Malaysia.

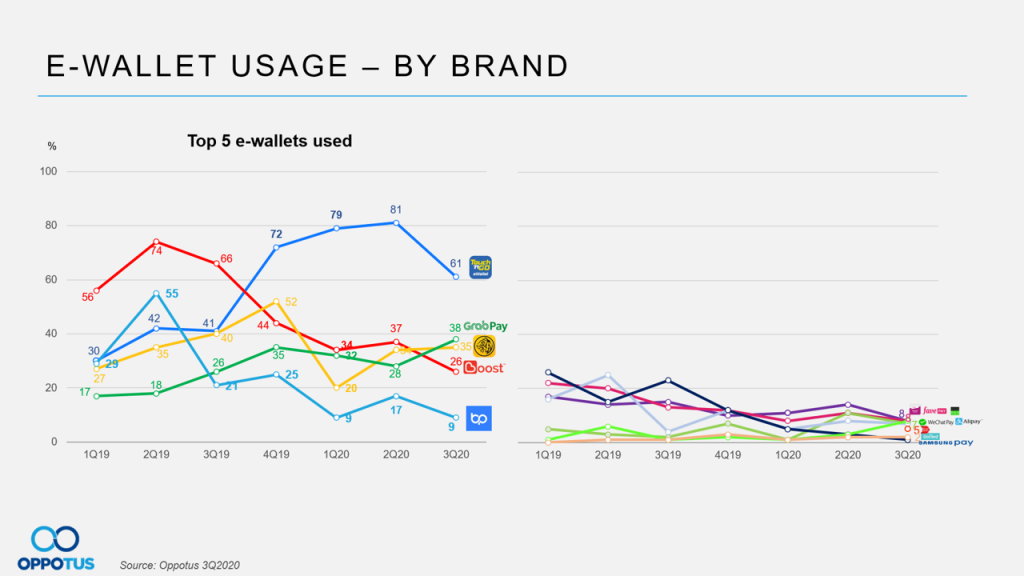

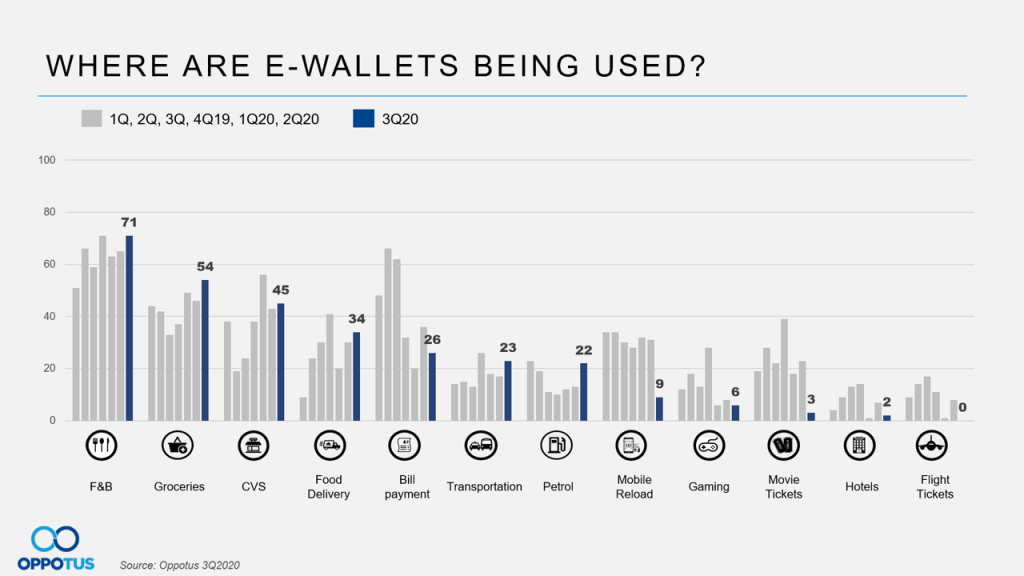

Refer to Figure 12 shows that e-wallet of GrabPay 37 continues to dominate the market. 16 to 24 years old. Last year has been an aggressive one in terms.

52 However this method is expected to be the fastest growing between 2019 and 2021 with uptake increasing at a compound annual growth rate of 53 percent to 2021 by which point it will take a 16 percent share of the Malaysian. 35 to 44 years old. The same is happening in Malaysia.

Twitter Facebook LinkedIn. Increase in e-wallet transaction volume Increase in merchant registrations for QR code payment acceptance 25 billion 17 billion 2020 2019 06 billion 03 billion 2020 2019 773k 293k 2020 2019 Source. The e-wallet usage statistics by Carousell Malaysia.

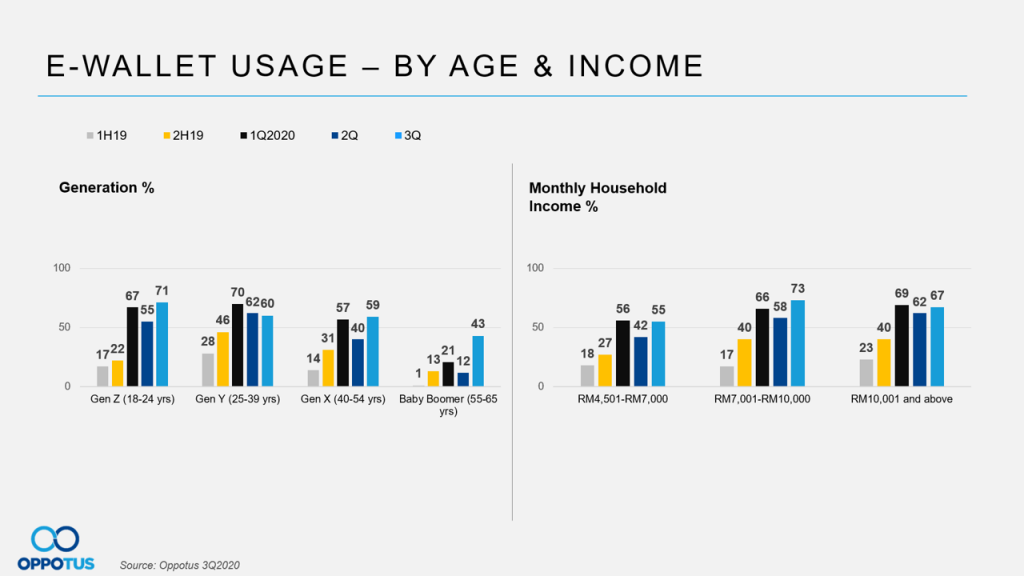

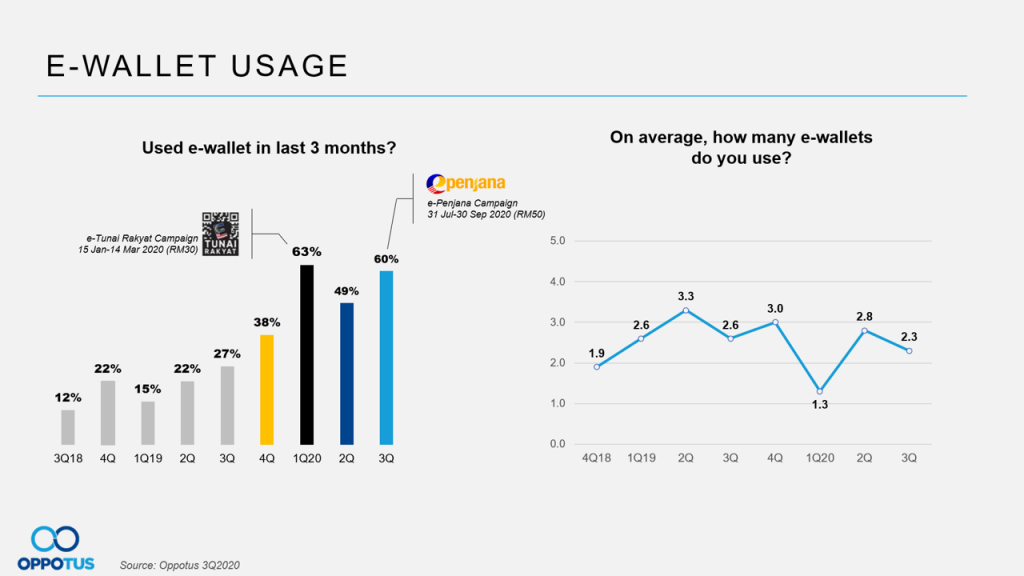

Bank Negara Malaysia Diagram 2. The study also revealed that on average Malaysian customers used 2-3 e-wallets during Q3 2020. The preferred device for accessing e-commerce in Malaysia is smartphones 52 percent followed by desktops 42 percent and tablets 6 percent.

According to a survey done by PwC Malaysia in 2018 only 22 of the respondents were e-wallet users with only 9 of respondents expecting to use their e-wallets more than 6 times a week. Frequency of making e-payments among respondents in Malaysia in 2020 by age. 45 to 54 years.

Monetary incentives have been used to promote the use of e-wallet Mat Arif 2020. Its CEO Mohd Khairil Abdullah pic said the growing awareness and leaps. Greater e-remittance adoption E-remittance remains an attractive option E-remittance share Growth in the value.

Carousell one of the worlds largest and fastest growing classifieds marketplaces conducted a voluntary response in-app survey on e-wallets with its Malaysian users recently and found that there is a group that keeps more than. To date there are a total of 53 e-wallets in the country with the industry occupying 19 of Malaysias fintech space according to a 2019 report by Fintech Malaysia Fintechnewsmy. The remaining e-wallet such as KiplePay RazerPay and Vcash show that the usages are 2 respectively.

This is followed by its closest competitor e-wallet Alipay 14 Boost 11 and WeChat Pay 9. List of eWallet in Malaysia 2020. I hope they continue to offer this e-wallet user I cant really use my e-wallet anywhere because many places dont accept it.

E-wallet market race. The intention to use e-wallet is in line with the initiatives of sustainable economic development via sharing economy. Maybank2u Boost and others alternative payment methods.

Taking a closer look at the demographics of Malaysian e-wallet users we find that e-wallets are most commonly used amongst the 25-34 age group with the 35-44 age group also having a solid percentage of e-wallet users at 25. This upward trend doesnt seem to be slowing down anytime soon especially as the accelerated growth of e-wallets in the country is in line with the central banks aim to. E-wallet user.

With the high Internet penetration of more than 80 per cent in Malaysia more Malaysians are poised to use digital wallets in the near future coupled with a robust e-commerce market value of more than RM1714 billion as reported by investment and financial services company JP. The reluctance of consumers to part with their credit and debit cards paired with the fragmented e-wallet market contributed heavily to the slow adoption rate. Another study regarding e-wallet trends in Malaysia by Oppotus found that 60 of the Malaysian customers have used an e-wallet in Q3 2020 which is more than double the number from 27 in Q3 2019.

Over 50 of Carousellers are e-wallet users Grabpay Touch n Go and Boost lead the pack. Malaysia has a mobile wallet usage of 40 ahead of other countries like the Philippines at 36 Thailand at 27 and Singapore at 26. Banking on the e-wallet in Malaysia Based on PwC Malaysias estimates the e-wallet market is projected to grow to c.

Malaysias digital shift has been ongoing for the past decade but the pandemic has accelerated digital banking adoption the report says. USD20bn by 2024 underpinned by favourable industry growth dynamics and market potential Cashback is very attractive. The prominence of e-wallets in Malaysia has grown significantly in the past few years with its huge growth mainly driven by the governments efforts and active marketing efforts by various companies.

The input for the study was gathered from 10000. We can also see that e-wallet usage is more common amongst those who are working in PMEB roles people who might be more likely to. Similarly Malaysia is experiencing a similar situation.

The Mastercard Impact Study 2020 found that Malaysia leads other countries in Southeast Asia when it comes to mobile or digital wallet usage.

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

Biggest E Wallet Trends In Malaysia Sticpay

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

Posting Komentar untuk "Statistics Of E-wallet Users In Malaysia 2020"