Late Payment Interest Calculator Malaysia

Credit Card Calculator For Interest Rates In Malaysia 2020. LATE PAYMENT INTEREST CUSTOMS ACT 80A.

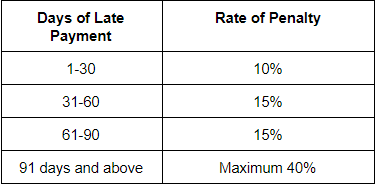

Malaysia Tax Penalty For The Late Payment Of Tax

Default interest or late payment interest at 18pa compound interest in addition to a on the amount of each instalment.

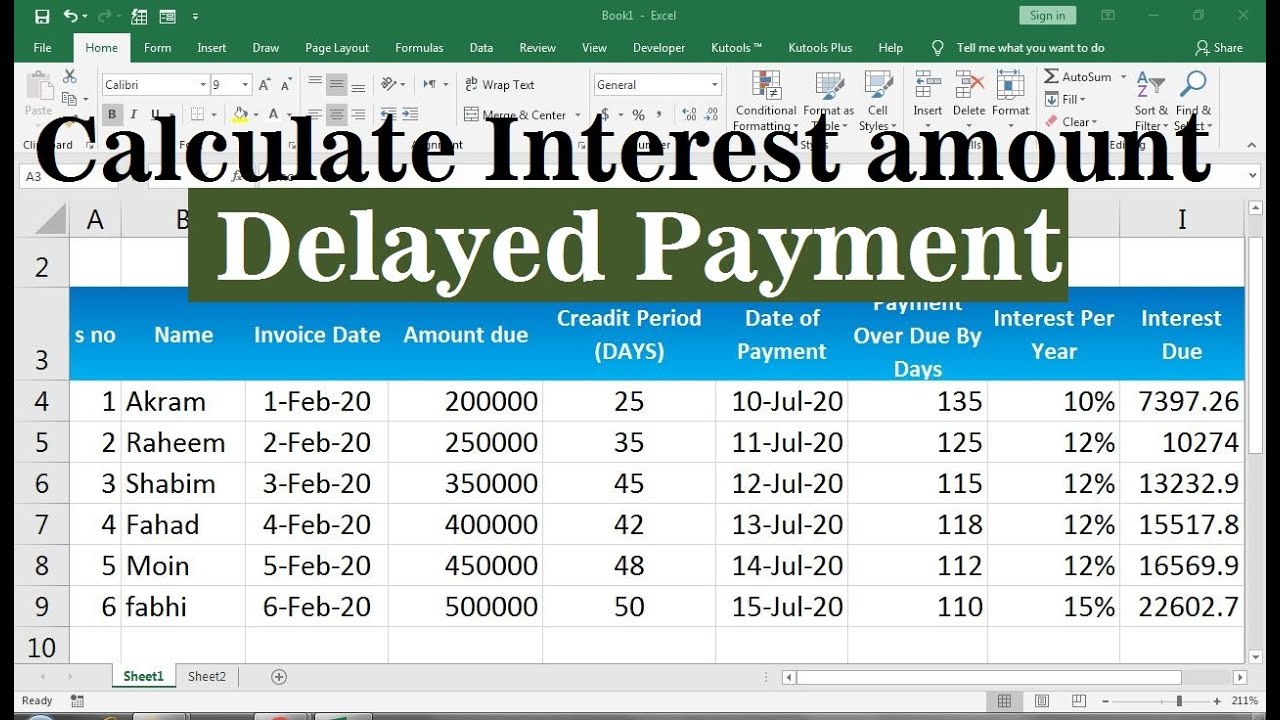

Late payment interest calculator malaysia. Penalty for Late Income Tax Payment. A quick calculation of the days sales outstanding based on the audited financial statements of Malaysian corporations compared with the normal credit. Using the formula an invoice in the amount of 1500 paid 10 days late and at an interest rate of 6625 would be calculated as follows.

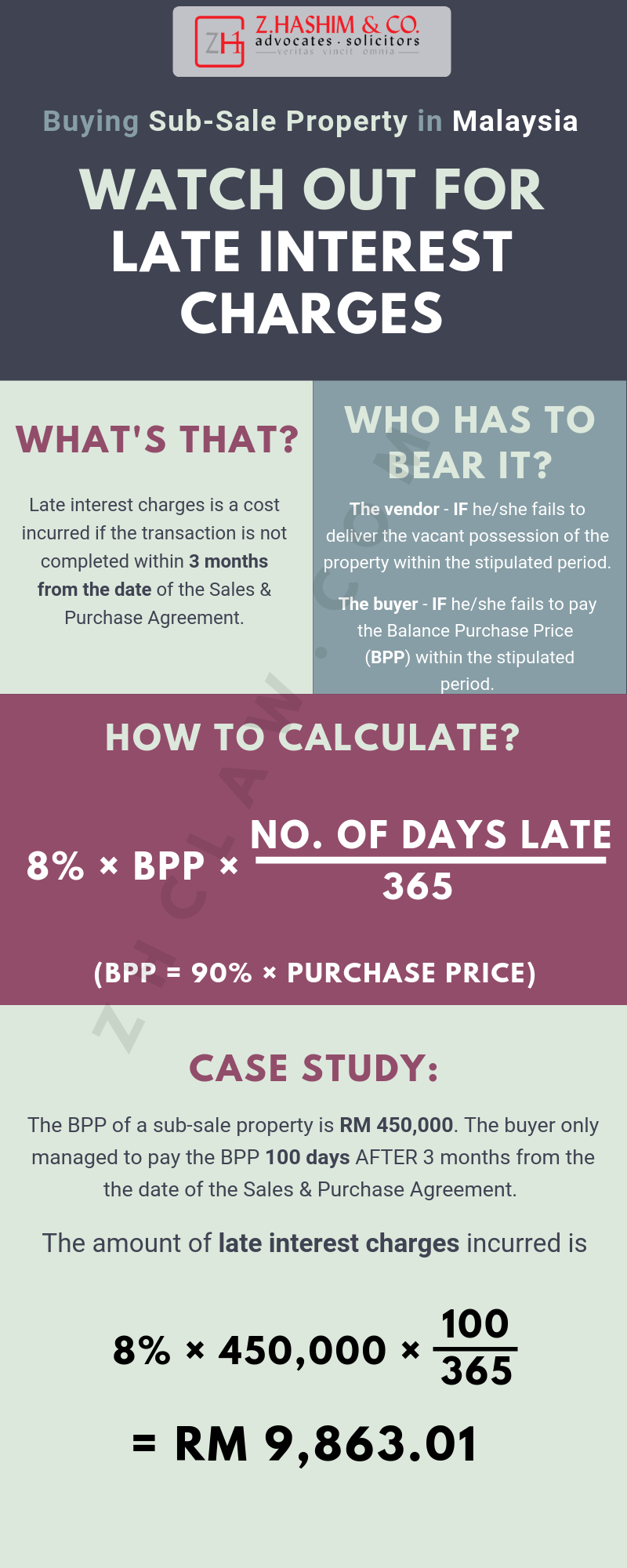

Here is the formula you can use to calculate the late interest charges. Of days late 365 BPP 90 Purchase Price Example of Calculation. 8 BPP No.

2 Amount you save on 1st month will enjoy 11 month interest 2nd month will enjoy 10 months interest etc. You cannot charge late payment interest until your invoice becomes overdue. As per Income Tax Act ITA 1967 payment of income tax income tax has to be settle by the due date.

Calculate the total credit card interest payable. Minimum RM5 or 1 of the total outstanding balance as of the statement date whichever is higher. Or if you want to use your financing rate of 450 as AFR then you will charge the customer a rate of 450 x instalment ie.

2 3 or 6 months. The buyer only managed to pay the BPP 100 days after 3 months FROM the date of the Sales Purchase Agreement the completion date in a normal sub-sale. Penalty will be imposed for any payment made after the due date.

12 months RM375. For more information about or to do calculations specifically. In addition to calculating the late fee the calculator will also calculate the daily penalty interest rate and the total amount due.

RM30 per late payment max RM60 per purchase FavePay Later. Calculate the total amount youd have to pay in the end. 1The rates of interest and each of them and charging the same on compound interest basis is excessive harsh and unconscionable.

For example if payment is due on April 1 and the payment is not made until April 11 a simple interest calculation will determine the amount of interest owed to the vendor for the late payment. Late payment fee. Late payment charges effective 20 April 2012.

Once the Notification for Relief is served all late payment interest and charges that are chargeable on arrears that accrued between 1 February 2020 to the end of the relevant prescribed period will be capped at an amount equal to 5 per annum of simple interest on the arrears. RM5 or 1 on outstanding amount per late payment - whichever is higher. In January 100 x 4 x 11 12.

Enter down payment amount in Malaysian Ringgit. This Late Fee Calculator will help you to quickly calculate the interest penalty on overdue invoices. 1 Whatever you have left last year will enjoy full interest payment this year.

Please refer to this link for the relevant prescribed period. RM375 RM1000 x 450 pa. Late payments are capped at a maximum RM100 per.

You can make payment at any MEPS ATM or online using Instant Transfer to have your payments transferred immediately and avert any late payment costs. Enter loan interest rate in Percentage. To calculate the late payment interest due on your overdue invoice please input the date that the invoice was due for payment.

Generate principal interest and balance loan repayment table by year. To the extent permitted by law the Finance charges are imposed on the. The amount you intend to owe.

Enter the invoice value the date the payment became overdue and the date payment was received and find out how much interest you can charge. The BPP of a property is RM 450000. Enter the payment amount in months ie.

The Late Payment of Commercial Debts Interest Act 1998 ensures you get compensated use our comprehensive late payment guides to help you make a claim. In short EPF interest calculation is pro rated. Enter the credit card balance ie.

Find out how much money you could be saving on interest and late penalties by. The monthly amount you intend to pay. Your instalment of RM1000 will now have a late payment charge of 083 sen RM1000 x 1 pa.

Enter property price in Malaysian Ringgit. Enter housing loan period in Years. Malaysia Housing Loan Interest Rates.

The Payment Calculator can determine the monthly payment amount or loan term for a fixed interest loan. Date of Payment of Duties. In February 100 x 4 x 10 12.

Late payments are capped at a maximum RM50 per account. Use the Fixed Term tab to calculate the monthly payment of a fixed-term loan. 12 months RM083 which you keep as compensation.

Then the late payment interest is 8 per annum Late for 20 days This means the late payment charge is RM 35000 x 8 365 days X 20 days RM 15343 Correct. RM750 to RM75 per late payment. 100000 x 4 4000.

Unless terms are agreed both public and private sector payment terms are 30 days. Enter the credit card interest rate in percentage. 1 Any duty specified in a notice of assessment is due and payable on the date specified in the notice being a date not less than 5 clear working days after the date of the issue of the notice of assessment or a date not less than 5 clear working days after.

Minimum RM10 or 1 of the total outstanding balance as of the statement date whichever is higher. Base Lending Rate BLR 66. Late Payment Interest Calculator to Calculate Interest on Overdue Invoices.

The compound late payment interest charged is also a penalty. How Do You Calculate Late Payment Interest. For individual with employment no business income the dateline is 30th April while individual with business income the dateline is 30th June.

1500 06636010 275. Divide the number of days past due by 365 then multiply it by the interest rate and the amount of. If minimum payment is not made by payment due date a late payment charge will be levied at 1 of unpaid balances from retail transactions and cash advances subject to a minimum of RM10 up to a maximum of RM100.

15 of outstanding payable amount per late instalment. Use the Fixed Payments tab to calculate the time to pay off a loan with a fixed monthly payment.

Late Payment Interest Payment Calculator Kpmg Romania

The Progressive Payment Schedule For Property In Malaysia Free Malaysia Today Fmt

Late Payment Interest Calculator Excel Youtube

Buying Property The Late Interest Charges Z Hashim Co

Housing Loan Calculator Malaysia Interest Rate 2021 Propertyguru Malaysia

Posting Komentar untuk "Late Payment Interest Calculator Malaysia"