Real Property Company Malaysia Lhdn

Its aim is to make foreigners lose their hard-earned money to help the Malaysia coffers that had been depleted. The exception being profit accruing from.

Real Property Gains Tax Rpgt In Malaysia 2021

INLAND REVENUE BOARD MALAYSIA INCOME FROM LETTING OF REAL PROPERTY Public Ruling No.

Real property company malaysia lhdn. In simplest terms its a tax on your net profit when you sell a property. 51 A business of holding of an investment means a business of letting of real property where a company in any year of assessment provides any maintenance services or support services in respect of the real property. RPC is essentially a controlled company where its total tangible assets consists of 75 or more in real property andor shares in another RPC.

What is Real Property Gain Tax RPGT Malaysia. A controlled company is essentially a company owned by not more than 50 members and. I had written two earlier posts that explained on the RPGT.

It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price. RPGT and Retention Sum policy Real Property Gain Tax RPGT and Retention Sum policy was a trap for foreigner who bought properties in Malaysia. LETTING OF REAL PROPERTY Public Ruling No.

Operasi LHDN Adil Kepada Pembayar Cukai Berita Harian - 8 December 2017 Dont take tax estimates lightly IRB warns companies and individuals The Malaysian Reserve - 23 November 2017 IRB Keeping A Close Eye On e-Commerce Transactions The Malaysian Reserve - 14 September 2017. Under the Real Property Gains Tax Act 1976 RPGT Act an RPC is a controlled company which the defined value of its real property or shares in another RPC or both is at least 75 of the value of its tangible assets. 10 March 2011 Issue.

Following the previous post on Real Property Gains Tax RPGT this post aims to shed a spotlight on another field of transaction which will also attract RPGT- sale of shares in a Real Property Company RPC. To act as agent of the Government and to provide services in administering assessing collecting and enforcing payment of various types of taxes income tax petroleum income tax real property gains tax estate duty stamp duties and such other taxes as may be agreed between the Government and the. Both individuals and companies are subjected to RPGT.

This means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any. Defined value DV i. 6 Steps to Calculate Your RPGT Real Property Gains Tax in Malaysia.

According to the Real Property Gains Tax Act 1976 RPGT is a form of Capital Gains Tax in Malaysia levied by the Inland Revenue LHDN. Relevant Provisions of the Law 1 3. Controlled company - interpreted under Section 2 Income Tax Act 1967 ITA 1967 as a company having not more than fifty members and controlled by not more than five persons in the manner described by Section 139 ITA 1967.

42011 Date of Issue. RPGT was first introduced in 1976 under the Real Property Gains Tax Act 1976. DV value for real property means market value of the real property.

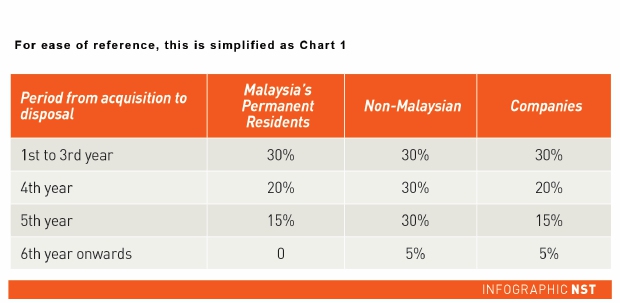

The form together with the payment must be submitted to the Collections Branch at the following locations. Levied by the Inland Revenue Board or Lembaga Hasil Dalam Negeri LHDN RPGT is a tax imposed on gains derived from disposal of real property. Real property gains tax RPGT Real property gains tax is applicable only if your company disposes of chargeable assets such as houses commercial buildings farms and vacant lands and also shares in real property companies gaining profit from the disposal.

Before we discuss Lees case I want to point out some important obligations a company director must be aware of when disposing of substantial valued assets exceeding 25 of the total assets for an investment company holding properties in Malaysia. 19 December 2018 CONTENTS Page 1. The tax deducted shall be remitted to LHDN within one month after distributing such income by completing the prescribed form CP 37E Appendix B.

Letting of Real Property as a Business Source 2 5. Real property is defined as any land situated in Malaysia and any interest option or other right in or over such land. Letting of Real Property as a Non-Business Source 4 6.

A real property company is defined as a controlled company that owns real property or shares in real property companies or both whereby the market value of the real property or shares in real property companies or both is not less than 75 of the value of the companys total tangible assets. It was introduced as a means for the government. LHDN is responsible for the following functions and duties.

Lembaga Hasil Dalam Negeri Malaysia Unit Pungutan Aras 3 6 7 8 15 Wisma Ting Pek. RPGT is also charged on the disposal of shares in a real property company RPC. In Malaysia Real Property Gains Tax RPGT is a tax imposed by the Inland Revenue Board LHDN on chargeable gains which find their source in the disposal of real property.

Real property is defi ned in the RPGT Act. Pursuant to Real Property Gains Tax Act 1976 Real Property Gains Tax RPGT is tax charged by the Inland Revenue Board LHDN on gains derived from the disposal of real property such as land and building. In simple terms RPGT is chargeable on the profit gained from the sale of a property or shares in a Real Property Company and is payable to the Inland Revenue Board of Malaysia IRB the taxman also known as the Lembaga Hasil Dalam Negeri LHDN.

Will be subject to real property gains tax. B Page 4 of 26 Cyberjaya Flagship Zone to an approved MSC status company is regarded as. Real Property Gains Tax RPGT is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia.

122018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Real property means any land situated In Malaysia and any interest option or other right in or over such land. 52 This definition is provided under subsection 60F2 of the ITA from the year of assessment 2006.

The Malaysian Companies Act 20163 Real propertyshares in RPCs The controlled company must hold real property or shares in an RPC and the defi ned value of the real property shares in the RPC must make up at least 75 of the total tangible assets of the company for the company to be an RPC. Generally Malaysia does not charge any capital gains tax neither does Malaysia have a CGT regime on sale of shares. This fact is specified in the Real Property Gains Tax Act 1976 Act 169.

What We Need To Know About Rpgt

What Is Real Property Gains Tax The Star

Investment Real Ising Property Gain Tax

Posting Komentar untuk "Real Property Company Malaysia Lhdn"