How To Calculate Tax On Epf Withdrawal

And this letter has to be submitted along with the PF joint declaration form. EPF withdrawals post-retirement age of 58 years is completely tax-free.

Income Tax Tds On Epf Withdrawal Before 5 Years Planmoneytax

EPF is one of the safest debt-based savings instruments available in India as it is backed by the government.

How to calculate tax on epf withdrawal. Latest updates on EPF. If PAN is not provided TDS shall be deducted at highest slab rate of 30. If you do not withdraw the EPF funds post three years of retirement you will have to pay tax on the interest earned.

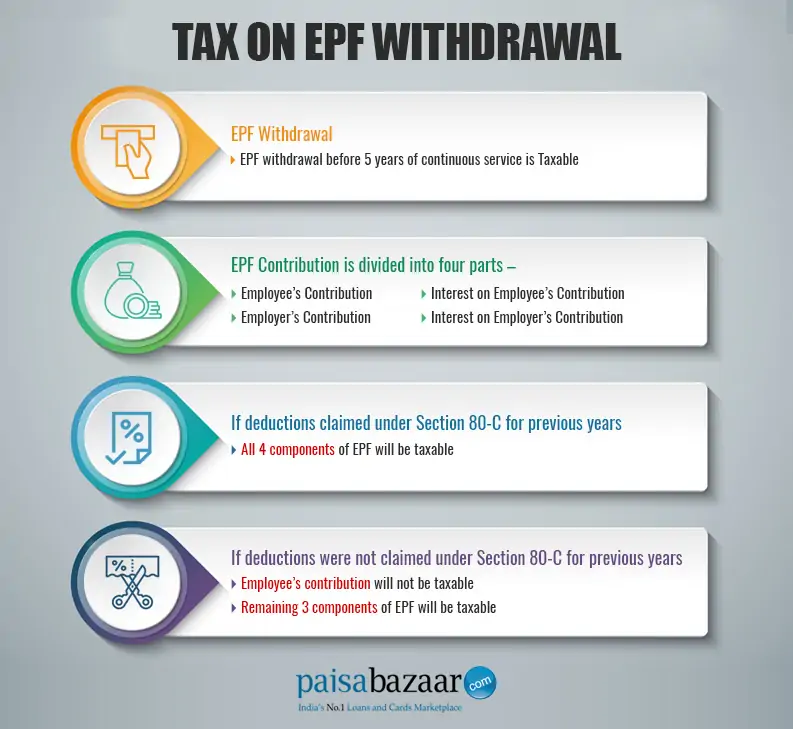

Exempt-Exempt-Exempt category of savings products. The interest on the EPF amount is taxable as per applicable income tax slab rates. As far as the tax implications are concerned EPF withdrawals attract zero tax if the withdrawal is done after 5 years of continuous employment.

EPF members can correct their name online in the UAN member portal by using their Aadhar number but sometimes when the name difference is too big then you or your employer has to write a request letter to the EPF office to correct the name. If the withdrawal takes place before 5 years the amount so withdrawn is added to the taxable income and taxed as per the marginal rates of tax. The new rule implies that any contribution made towards Provident Fund PF of Rs 25 lakh and above in a year and interest saved on it will now.

Raote says If the claim is filed after leaving the job then one must ensure that the claim is filed after one month of the last contribution date. You can submit Form 15GForm15H if tax on your total income including EPF withdrawal is nil. However if the EPF withdrawal claim is filed due to any other reason such as job loss marriage etc.

Any advance made under the EPF Scheme is exempt from tax. And it gets a super investor-friendly tax treatment that makes EPF a tax-free investment instrument for the salaried class having the status of EEE ie. The finance minister of India Nirmala Sitharamanannounced a new tax limitation to the EPF contributions.

TDS is not deducted if Form 15GForm 15H is. TDS is deducted 10 on EPF balance if withdrawn before 5 years of serviceRemember to mention your PAN at the time of withdrawal. Then there are additional conditions that must be met.

New Tax Limitation for EPF All You Need to Know.

Tax On Epf Withdrawal Rule Flow Chart Paying Taxes Personal Finance

Epf Withdrawal Taxation New Tds Tax Deducted At Source Rules

Tax On Epf Withdrawal New Tds Rule Flowchart Planmoneytax

Now Provide Year Wise Pf Details To Calculate Tax On Epf Withdrawal

Epf Withdrawals New Rules Provisions Related To Tds

Posting Komentar untuk "How To Calculate Tax On Epf Withdrawal"