How To Apply For Sme Loan

If youre not eligible for Covid-19 relief loans well offer you a suitable commercial loan. Fast access to standby cash to support daily operations.

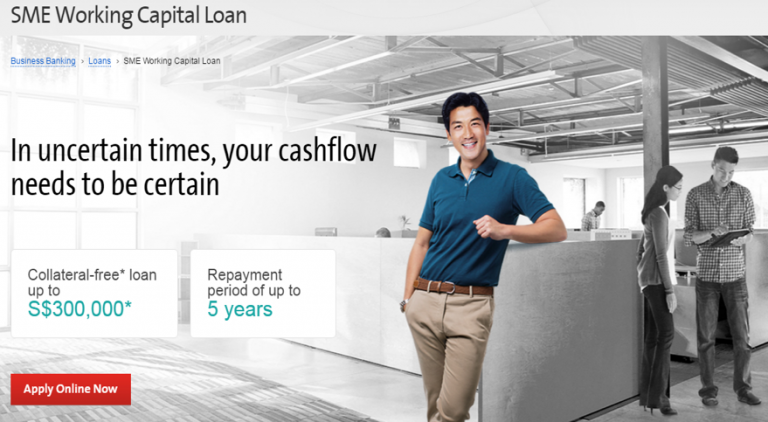

Sme Working Capital Loan Collateral Free Ocbc Business Banking Sg

At least 30 owned by Singaporean or Singapore PR.

How to apply for sme loan. Youll be considered for the Temporary Bridging Loan as it is probably the most favourable offer for most businesses. Most customers apply for the SME Working Capital Loan only after they have exhausted the loan quantum of Temporary Bridging Loan. Complete the application form provided by MFI The application form is provided by the microfinancing institutions MFIs and there are at least 290 MFIs in the country See the list here.

SME Working Capital Loan. We get you personalised offers in no time for free. Start application process on AGSMEIS LOAN PORTAL and select KUDI KONSULT SERVICES Under Kwara State as your preferred training Institute Note that your location does not matter because NIRSAL MFB has allowed online trainings and we have a well developed online training system which is conducted via.

Support daily operational cash flow. Submit Application in the nearest branch. Follow this easy 5-step guide to applying for this loan online.

Should you have any enquiry please kindly contact DBS BusinessCare at 1800 222 2200. Interest rate structure. Apply online for collateral free SMEMSME Loan with ICICIdirect for micro small and medium business.

Depending upon completion of required documents. Upload bank statements of the last 6 months. Branch Network From initial assessment and documentary evidence verification a maximum of 30 days till loan approval.

We get you personalised offers in no time for free. Click here for list of Sectors Financed by SME Bank Ltd. It is a channel to facilitate SMEs to access non-collateral financingloans which allow SMEs to.

Check out the complete details here Equity. Aside from applying funds from commercial banks in the market SME business owners can opt to apply SME loans from other service financial providers namely the Development Financial Institutions DFI. Must have at least 30 local equity held by.

Commonwealth Bank of Australia Bankwest. The following lenders have been approved to participate in the SME Recovery Loan Scheme. Apply for loanfinancing from a single platform.

Download and save the Enterprise Finance Scheme application form here. To qualify for SME Working Capital loan this criteria set by financial institutions must be met. Application details must be completed Name address business history and banking details.

Fast and Convenient Online Application. Ad Strengthen Cash Flow Diversify Revenue Streams. Looking for a cash loan in Singapore.

Ad Apply for free with Lendela and receive loan offers from Singapore lenders within minutes. Revolving line of credit. The Government is currently considering applications from lenders interested in participating in the SME Recovery Loan Scheme.

Our SME Loans range from K1000 to K300000. Must be registered operating and physically present in Singapore. Access fast and real-time information on financingloan options anytime anywhere 247.

Open the application form in Adobe Reader free download. Enter your personal business and financial details. Loan repayment term is from 12 to 48 months with an interest rate charge of 15 per annum.

Up to 5 years. OCBC bank requires guarantor s to support the loan. Group annual sales of up to S100m or group employment size of not more than 200.

Reporting of fraud or suspicious transactions. Search for financingloan by participating banks at their convenience hassle-free. Ad Strengthen Cash Flow Diversify Revenue Streams.

Backed by the government they are financial services providers that offer targeted financial assistance. When applying for a loan the following requirement are integral and MUST be provided to the bank at the time application is lodged. Ad Apply for free with Lendela and receive loan offers from Singapore lenders within minutes.

Fast and Convenient Online Application. What are the steps to apply for the loan. Apply Via MyInfo Business Today.

Click here for Request Information. Click on Apply Online to open the application form. 3 Apply online for an MSME loan Once you pick the proper financial institution or monetary group for acquiring a Micro Small and Medium Enterprise mortgage you could without problems observe this mortgage online with the aid of filling out the online software form to be had at the website of the monetary group which you pick.

Up to 5 years. Businesses who benefited from phase 1 and phase 2 of the scheme can apply through the SME Recovery Loan scheme as well. Small To Medium Enterprise Loan sme This loan is available to NCSL members who have a new or existing small business.

For details and instructions on how to compile all required supporting documents for submission refer to. Looking for a cash loan in Singapore. This form is not for urgent submission of information eg.

Apply Via MyInfo Business Today. Terms and conditions apply.

Png Sme Aid The Government Has Allocated K80 Million To Ndb From The K200 Million Sme Loans Below Is The Breakdown Of The Allocation By Ndb K40 Million To Msme Agriculture K24 Million

How To Apply For Sme Working Capital Loan Gm Creditz

Sme Loan Comparison Business Loan Dbs Businessclass

Best Sme Loan Singapore 2022 Free Loan Comparison Tool

Four Things To Prepare When Applying For Govt Assisted Sme Loans With Validus Validus

Posting Komentar untuk "How To Apply For Sme Loan"