Tax Relief 2021 Malaysia Travel

Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner 8000 Restricted 3. This special tax relief was extended to 31 December 2021 and at the tabling of Budget 2022 earlier today this relief will be further extended to cover the 2022 year of assessment.

Personal Tax Relief 2021 L Co Accountants

In late February this year it was announced under the 2020 Economic Stimulus Package that Malaysians who travel locally can enjoy special personal income tax relief up to RM1000.

Tax relief 2021 malaysia travel. Receiving full-time instruction of higher education in respect of. Individual and dependent relatives. YA 2021 RM Self.

To promote domestic tourism the personal income tax relief of up to RM1000 for expenses incurred on domestic travel between 1 March 2020 and 31 August 2020 announced under the Economic Stimulus Package 2020 will be extended to 31 December 2021. If you are in a state that has a tax treaty with Malaysia you will not be taxable if you are present for less than 183 days. Per child over 18 years old.

The government should further incentivise domestic travel through a special personal income tax relief of RM8000 per person for domestic travel packages purchased through licensed travel. Purchase of basic supporting equipment for disabled self spouse child or parent. With effect from YA 2021 the relief includes an increase in complete medical examination of up to RM1000.

Those planning to take advantage of this tax relief for next year can check out the list of registered hotels under the Ministry of Tourism Arts and Culture. Further the scope is also expanded to include vaccination expenses of up to RM1000 for taxpayer spouse and child. I arrived in Malaysia for a.

What can make it fun is finding out the tax reliefs and rebates. Getting A Tax DeductionTax Incentive For Your Company. With the government allowing interstate travel and also the new relief of up to RM1000 so why not cuti-cuti Malaysia.

In such case you may apply for credit relief under the ITA 1967. Thanks to the Economic Stimulus Package 2020 announced by Interim Prime Minister Tun Dr Mahathir Mohamad yesterday Malaysian can now to claim up to RM1000 Income Tax Relief on domestic travel. The list goes as follows.

Per child below 18 years old 2000. The prime minister announced that personal income tax relief in the amount of MYR 1000 on travel expenses incurred from 1 March 2020 to 31 August 2020 is to be extended to 31 December 2021. If your yearly income is above RM34000 you definitely cant escape it.

Payment for accommodation at premises registered under the Tourism Industry Act 1992. The applicable tax rates are set at 5 percent 10 percent exempted 0 percent or at a specific rate depending on the HS Tariff code of the goods. Disabled spouse - additional spouse relief.

Service Tax on the other hand is charged and levied on any prescribed taxable services provided in Malaysia by a registered person or any imported taxable services. So if you bought a computer that costs more than that you can no longer include your gym membership internet subscription and others for income tax relief. 32019 of Inland Revenue Board of Malaysia.

I am a non-resident individual. The relief given on the following expenses incurred on local travelling from 1 March 2020 to 31 December 2021. To encourage the up-skilling and re-skilling of Malaysian citizens the Government has proposed to expand the scope of this income tax relief to cover fees for attending up-skilling and self-enhancement courses in any field of skills recognized by the Department of Skills Development of the Ministry of Human Resources for YAs 2021 and 2022.

Yes there is a tax deduction for employers in Malaysia subjected to the terms and conditions set by the LHDN. - diploma level and above in Malaysia. This tax relief applies on payments made between 1 March 2020 and 31 December 2021 up to the amount expended limited at RM1000 for the assessment year.

If you are in a state that has no tax treaty with Malaysia you might be s ubject to taxation. Disabled individual - additional relief for self. You can already start doing your taxes but the deadline for e-Filing BE Formresident individuals with no source of income from running a business is 15 May 2021.

As is usual with tax relief claims you will need to keep the relevant receipts and supporting documents for seven years as it may be requested by LHDN as proof. Hence the tax relief is claimable by resident individuals for YA2020 and YA2021. The maximum income tax relief amount for the lifestyle category is RM2500.

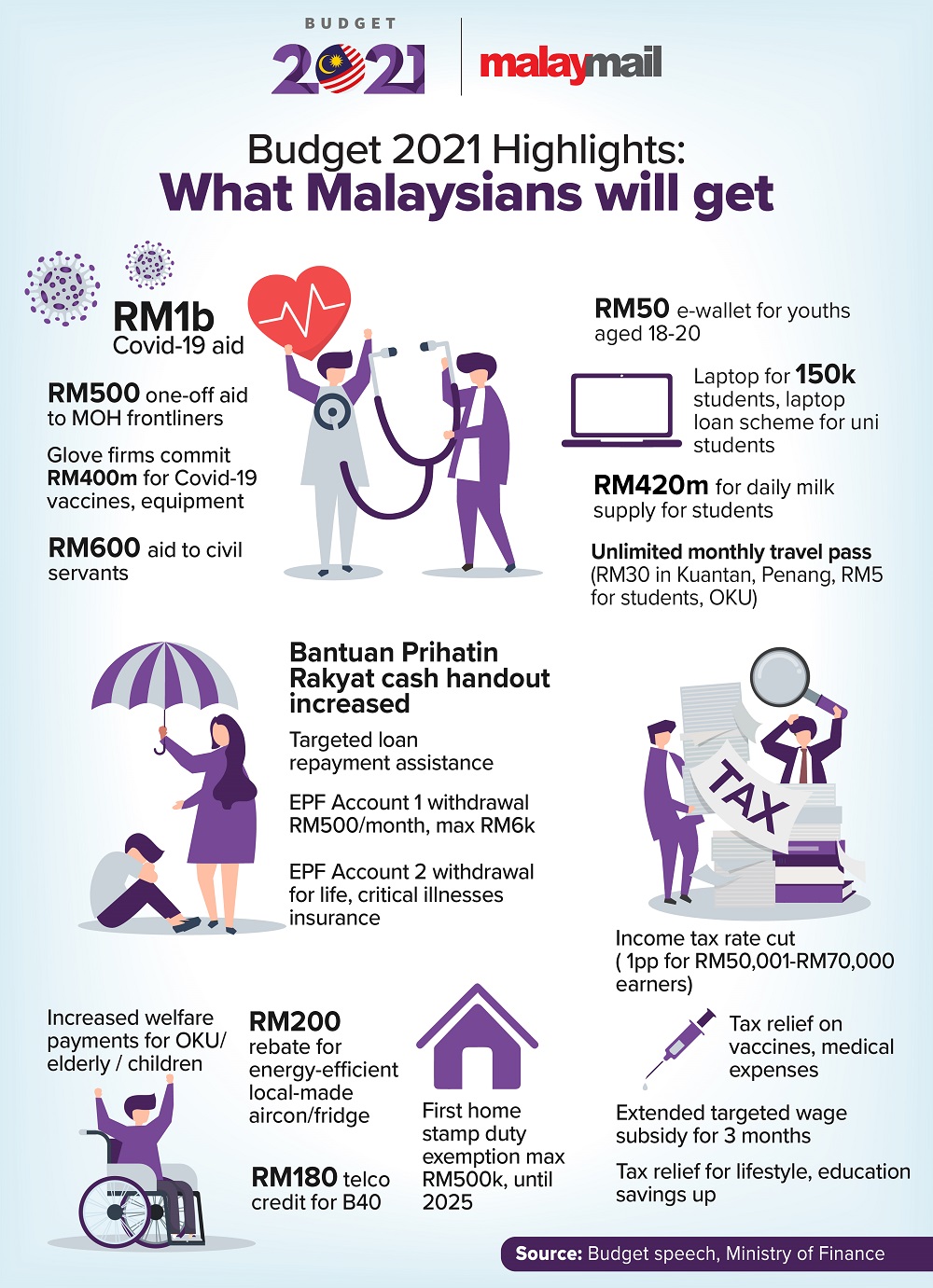

Do also take note. Hiring disabled worker - Employers are eligible for tax deduction under Public Ruling No. Budget 2021 is the largest budget in Malaysias history with a total of RM3225 billion compared to RM297 billion for Budget 2020.

Filing your income tax might not be fun but we all have to do it anyway. The income tax rates 2021 exemption limit for compensation for loss of employment will be increased from RM10000 to RM20000 for each. On top of that you are also eligible to receive RM100 worth of digital voucher to use on any domestic travel in the country.

The main objective is to help taxpayers who have lost their jobs due to the current pandemic. And under the PENJANA Economic Recovery Plan that was recently announced on 5th June 2020 this incentive is further extended until 31st December 2021.

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Malaysia Personal Income Tax Relief 2021

Budget 2021 Highlights Here S What Malaysians Can Expect To Get Directly Tax Breaks Handouts Subsidies And More Malaysia Malay Mail

Special Personal Income Tax Relief Up To Rm 1 000 For Domestic Travels Sunway Travel Sdn Bhd

Posting Komentar untuk "Tax Relief 2021 Malaysia Travel"