Income Tax Malaysia 2021 Tax Relief

Receiving full-time instruction of higher education in respect of. You can already start doing your taxes but the deadline for e-Filing BE Formresident individuals with no source of income from running a business is 15 May 2021.

Crowe Malaysia Updated The Tax Relief For Parental Facebook

Tax Relief for Disabled Person.

Income tax malaysia 2021 tax relief. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021. This where you may be able to reduce the amount of income even further with tax rebates. So if you bought a computer that costs more than that you can no longer include your gym membership internet subscription and others for income tax relief.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Ii Disabled Spouse RM 5000. Tax reliefs which can be claimed by resident individuals in Malaysia for YA 2020 and 2021.

On the First 5000. A tax deduction reduces the amount of your aggregate income which is the sum of your total income for the year put together. 4 December 2020.

It was previously announced that those with a chargeable income of RM50001 to RM70000 will see a tax reduction from 14 to 13 which is expected to benefit 14 million taxpayers in the country. But the final income tax amount still comes out a hefty sum. In the event the total relief exceeds the total income the excess cannot be carried forward to the following YA.

Malaysia presented the 2021 Budget proposals announcing a slight reduction in the individual income tax rate by 1 percent for resident individuals at the chargeable income band of MYR 50001 to MYR 70000. Real property gains tax RPGT exemption for Malaysians for disposal of up to three properties from June 1 2020 to December 31 2021. The maximum income tax relief amount for the lifestyle category is RM2500.

This relief is applicable for Year Assessment 2013 and 2015 only. Disabled spouse - additional spouse relief. The chargeable income is nil and no income tax is payable for that YA.

Filing your income tax might not be fun but we all have to do it anyway. There is also an increase an extension and an expansion of the scope of tax reliefs. Malaysia Personal Income Tax Relief 2021.

For those earning RM50000 to RM70000 a year the Income Tax Rates 2021 Personal Tax Rates 2021 lower by 1 point. YA 2021 RM Self. Malaysian personal tax relief 2021.

45 Tax Relief for Contribution to Private Retirement Scheme PRS Presently individual taxpayers are entitled to claim income tax relief of up to RM 3000 annually for their contribution to. Iv Basic supporting equipment For disabled individual spouse child or parent RM 6000. Malaysia Income Tax Deduction YA 2020 Explained.

Make sure you keep all the receipts for the payments. - diploma level and above in Malaysia. Individual income tax exemption of up to RM5000 to employees who receive a handphone notebook or tablet from their employer effective July 1 2020.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Tax rebate deducted from total tax payable. If youve received your Income Tax Return EA Form you may start filing your taxes now up until the deadline on April 30 2021.

What can make it fun is finding out the tax reliefs and rebates. The list of tax rebates for YA2021 are as below. Tax season is hereand as of 1 st March 2021 you can already start filing your taxesIf you are someone who has to pay taxes you would know that you can also get some exemptions or reliefs.

The relief amount you file will be deducted from your income thus reducing your taxable income. 1 The types of breastfeeding equipment that are entitled to this income tax relief in Malaysia are the breast pump kit manual and electronic ice pack breast milk collectionstorage equipment and a. Each unmarried child and under the age of 18 years old.

KUALA LUMPUR Dec 14 Tax exemption of up to RM1000 for individuals who take Covid-19 screening tests including for personal spouse or children are among the provisions under the Finance Bill 2021. This tax rebate is why most Malaysia n fresh graduates or those in. For income tax filing in the year 2021 YA 2020 you can deduct the following contributions from your aggregate income.

Below is the list of tax relief items for resident individual for the assessment year 2020. With the proposed Budget 2021 individual income tax at a flat rate of 15 be given to non-citizens holding key positions C-Suite positions for a period of 5 consecutive years. The individual income tax has been reduced from 14 to 13 percent for resident taxpayers in the 50000 ringgit US12375 to 70000 ringgit band US17325.

With the negative impact of the pandemic on the Malaysian market the Government has consider providing temporary tax breaks to individual taxpayers who have suffered salary reductions or job losses. The scope of this lifestyle income tax relief for printed daily newspapers to include subscriptions for electronic newspapers with effect from YA 2021. Calculations RM Rate.

Iii Disabled Child RM 6000. In Budget 2021 the government has announced measures to reduce the monetary burden faced of the rakyat with tax reliefs and reductions. For Child aged under 18.

Deputy Finance Minister I Datuk Mohd Shahar Abdullah said this is contained in the amendments of the Income Tax Act 1967. In other words after declaring your income you can get a rebate if you spent on certain things such as medical expenses education travel and so on. Per child over 18 years old.

I Disabled Individual RM 6000. If your yearly income is above RM34000 you definitely cant escape it. If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions.

Per child below 18 years old 2000. Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing. Tax relief deducted from chargeable income.

Under the PENJANA the Government announced tax incentive of 0 income tax rate for a period of up to 15 years for manufacturing companies that relocate their operations to Malaysia. This YA 2020 new tax reliefs have been introduced to lighten Malaysians financial and economic burdens brought on by COVID-19. Malaysias government has introduced several income tax amendments that will impact individual taxpayers for 2021.

Disabled individual - additional relief for self. You will be granted a rebate of RM400. Tax rebate for Self.

Say youve deducted every tax relief youre eligible for.

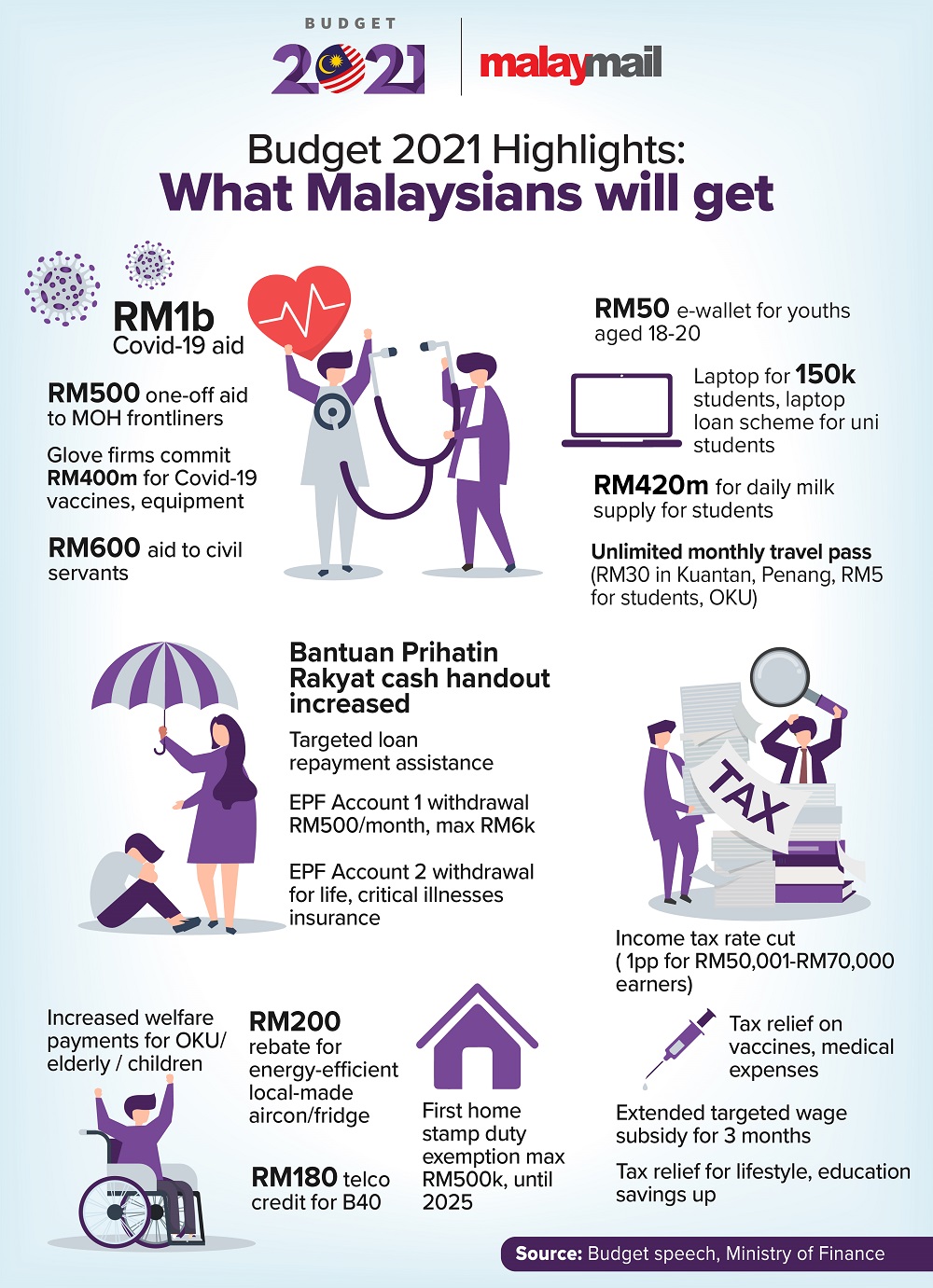

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Income Tax Breaks For 2020 The Star

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

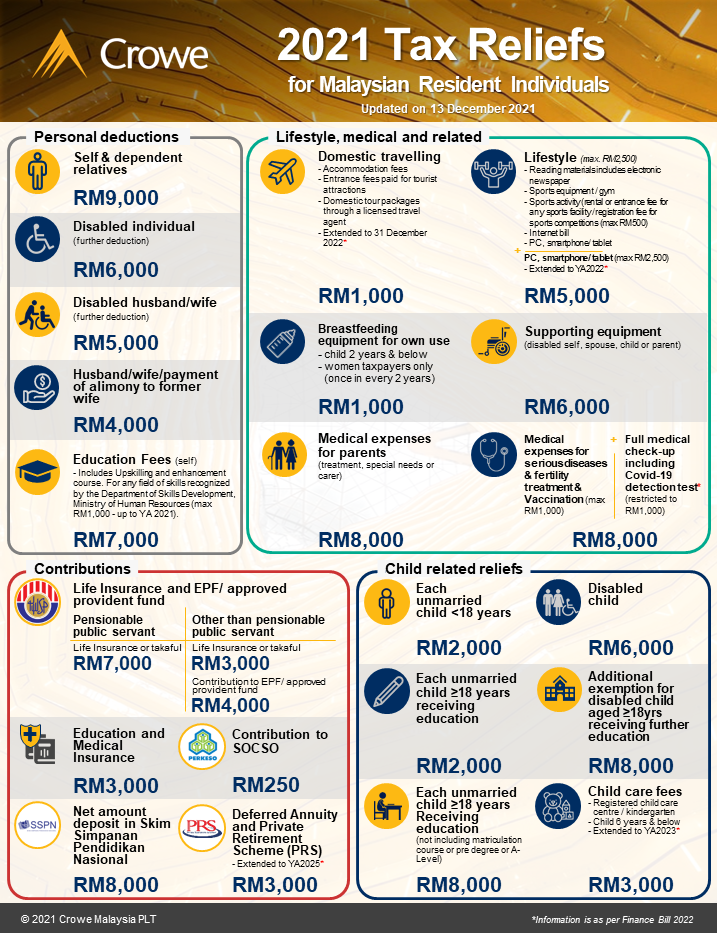

Budget 2021 Highlights Here S What Malaysians Can Expect To Get Directly Tax Breaks Handouts Subsidies And More Malaysia Malay Mail

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Posting Komentar untuk "Income Tax Malaysia 2021 Tax Relief"