Calculation Of Retrenchment Compensation Malaysia

VSS payment formula is based on a VSS multiple that ranges from 14 for executives to 16 for non-executives multiplied by the length of service capped at a maximum of 22 years multiplied by the basic salary or 50 of total monthly salary until retirement whichever is lower. The process of calculating retrenchment compensation When the employer is effecting a retrenchment it has to pay compensation at a rate of 15 days wages per completed year to be calculated.

What Is Form Pk L Co Chartered Accountants

It goes without saying that retrenchment is subjected to scrutiny by the Industrial Court of Malaysia.

Calculation of retrenchment compensation malaysia. Calculation of back-wages begins from the day of dismissal until the last day of the court hearing up to maximum 24 months while for employees on probation up to maximum of 12 months. 12 months Termination in 2020 and 2021. Please do not underestimate because sometimes it can be hard to land a new job.

Please answer the question. 12 months This amount is only applicable for loss of employment occurred in 2020 and 2021. If unfair dismissal is established the Industrial Court may order reinstatement or compensation in lieu of reinstatement and this will include back wages of a maximum of 12 months for a.

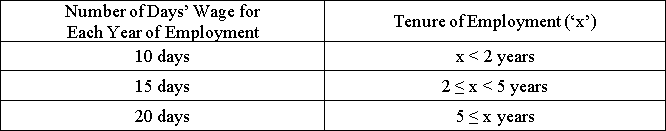

10 days of salary per year of employment 2 - 5 years. According to the Malaysian Employers Federation MEF more than 20000 employees were retrenched in 2015 as at September 2015. Average salary 1530 average salary of last 3 months number of completed years of service or part thereof in excess of 6 months.

B order employers to pay back-wages Note. The Employment Act 1955 and the Employment Termination and Lay-Off Benefits Regulations 1980 govern the retrenchment procedures of employees who earn not more than RM2000 monthly and manual workers irrespective of the number of their monthly salaries. 20 days of salary.

The calculation of compensation is generally depend on the employees length of service and salary. Average true days wages 1450 x. If the retrenchment compensation is received due to a scheme approved by the.

How much should his benefits be. As the name suggests average pay means the average of the last three months wages payable to a workman. My job is considered manual labour.

More than 5 years. Say an employee earning RM 1900 who has worked for 6 years is about to get retrenched. Entitled to two-thirds of their monthly salary or HK22500 3965 whichever is lower.

This is then multiplied by the number of years of service. The amount is pro-rated for shorter years. Retrenchment occurs when a company discharges surplus labour or staff.

Based on the compensation amount do your own calculation to see whether the amount is worth it. RM20000 for every completed year of service ie. 20 days wages for every year of service.

Retrenchment Procedures A Providing the Employee Notice. RM10000 for every completed year of service ie. Those who earn less than RM2000 monthly the requirement to pay retrenchment benefits and the quantum of retrenchment benefits would be in accordance with their employment contract if any.

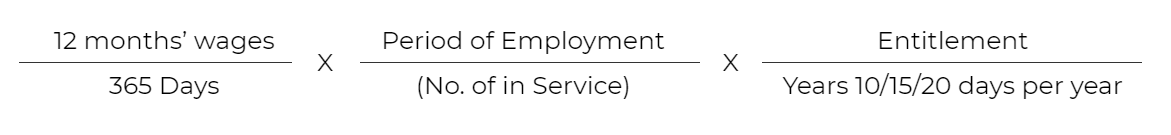

Entitlement and Calculation under the Employment Termination Lay-Off Benefits Regulations 1980 2 years service 10 days for every year. Employee Retrenchment Benefit Calculator. Should you decided to take up the offer do make sure the compensation amount is able to support you and your family for a sufficient amount of time.

Malaysias Human Resources Minister says that his ministry expects retrenchments to continue into 2017. For whatever the reasons a retrenchment exercise was carried out these are 4 basic legal principles that every employers or employee should know. Less than 2 years.

Redundancy as Precondition for Retrenchment. 5 years and above. The employer ceases intend to cease his business which the employed was employed.

The Malaysia retrenchment benefits for EA-eligible employees are as follows. 20 days remuneration for every year of service. She explained Under Malaysias taxation system gratuity would be taxed under s131a while the loss of employment would be taxed under s131e of the Income Tax Act 1967.

The following free calculator is provided by Low Partners to simplify the calculation of Retrenchment Benefit. 15 days wages for every year of service. Meanwhile retrenchment is linked to a loss of employment as the employee is being laid off prior to the end of the contract of service Choong added.

For employees who do not fall within the EA ie. The cap on statutory payments is HK390000 68700. Worked there for 8 years and 5 months and is earning RM1450 a month.

Entitlement as per Reg 6 of the Employment Termination Lay Off Benefits Regulation 1980 20 days for every month of service. Employers are required to submit an employment notification retrenchment form PK Form to any Labour Office failure of which carries a punishment of a fine of RM1000000. There is so much of confusion when comes to the calculation of Retrenchment Benefit notice required if the employer decides exercise retrenchment.

For employees who do not fall within the EA the obligation to pay retrenchment benefits and the quantum of retrenchment benefits if any would be in accordance with their employment contract if applicable. Calculation of average pay. 15 days of salary.

Employers are required to disclose information such as the reasons for the retrenchment number of workforce number of workers involved in voluntary separation scheme etc. Employee retrenched by company. Retrenchment compensation is to be calculated 15 days wages for every month comprising 30 days and not assuming 26 days as applicable under the Payment of Gratuity Act4.

Employees with at least two years of service. H L Kumar Labour Problems Remedies. There has been a wave of retrenchments in Malaysia which started last year and looks to continue through 2016.

It can be done in six situations as shown in section 123 of the Employment Act namely when. 5 years or more.

1thinking Retrenchment In Malaysia

Know The Difference Layoff And Retrenchment

Posting Komentar untuk "Calculation Of Retrenchment Compensation Malaysia"