What Is Islamic Capital Market

Within the arena of Islamic finance investment in the stock market is however guided by what is permissible or non-permissible by Sharīʿah principles. The factors driving the growth of the Islamic Finance market are directing investment toward the tremendous growth opportunities in the promising Islamic sectors.

Islamic Capital Market Ppt Video Online Download

It plays an important role in generating economic growth for the country.

What is islamic capital market. Developments and issues 137. The Conventional Capital market exists. Major financial markets are discovering solid evidence that Islamic finance has already been mainstreamed within the global financial system and that it has the potential to help address the challenges of ending extreme poverty and.

Capital markets are markets for buying and selling equity and debt instruments. The Islamic capital market is a prime example of a system that integrates values of Islam and that of modernity and progress simultaneously. To ensure this it forbids the unlawful devouring of others property by way of theft.

Capital markets channel savings and investment between suppliers of capital such as. The ICM functions as a parallel market to the conventional capital market and plays a complementary role to the Islamic banking system in broadening and deepening the Islamic financial markets in Malaysia. The book explains each topic from both the conventional and the Islamic perspective offering a full understanding of Islamic capital markets processes and instruments.

McMillen Islamic capital markets. A Islamic capital market ICM market transactions are carried out the method to face a conflict with the conscience of Muslims and the religion of Islam. The Islamic Capital Market exists for Islamic corporations and Muslim countries to raise capital in a Halal way following the laws of the Shariah.

In the ICM market transactions are carried out in ways that do not conflict with the conscience of Muslims and the religion of Islam. According to ISI Emerging Markets. The ICM is a component of the overall capital market in Malaysia.

As an important component of Islamic Financial System IFS Islamic Capital Market ICM has witnessed a tremendous growth in the recent years. Market price the assets are purchased by the client and resold by the financier as agent of the client. They do this in two ways by selling equity in the form of stocks and debt in the form of Sukuk.

Conventional finance includes elements interest and risk which are prohibited under Shariah law. From this verse we clear that we must keep away from illegitimate method for winning matters that are questionable and suspicious. Investing in Shariah-compliant securities is not limited to only.

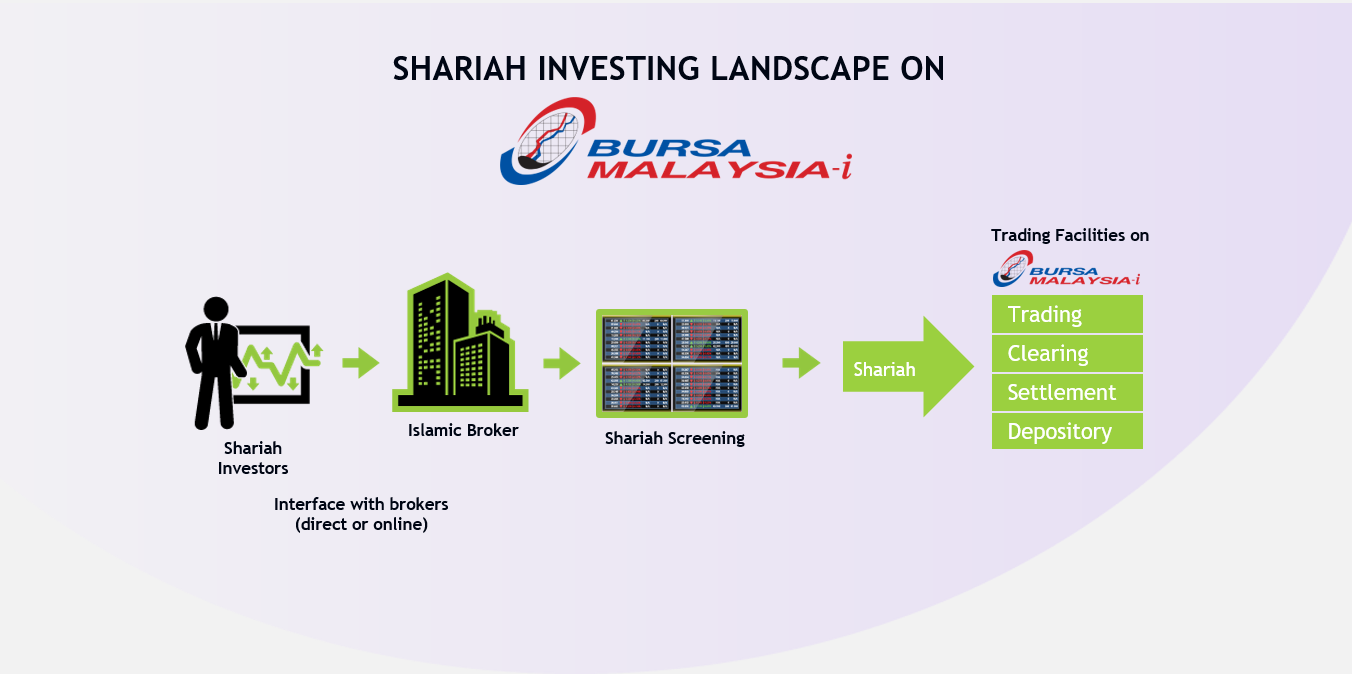

Presently there is one full-fledged Islamic stockbroking company with 3 other conventional stockbroking companies that provide Islamic windows in the ICM. The industrys total worth according to key industry stakeholder organizations across its three main sectors banking capital markets and TAKĀFUL global Islamic Finance assets increased by double-digit year. It is however a growing series of financial products developed to meet the requirements of a specific group of people.

As a capital markets case. Hence Allah has allowed trade and prohibits usury. SHARIAH ISSUES IN ISLAMIC CAPITAL MARKET Azahari Jamaludin drazaharifbftwintechedumy Twintech International University College of Technology ABSTRACT Islam considers the property of people as sacred and inviolable as their life and honour.

What is islamic capital markets. Raising capital is equally important to both the conventional market and the Islamic Capital Market except that there is a major difference in the nature of investments and investors choices. Islamic finance is expanding in capital market in the form of Islamic indexes Sukuk money market funds and equity market funds.

Fintech concepts such as digital investment management eg. Islamic Capital Markets. The Islamic Capital Market ICM functions as a parallel market to the conventional capital market in Malaysia.

9 THE ISLAMIC CAPITAL MARKET Islamic Investment and Services Malaysia offers a holistic set of ICM infrastructure ranging from products stockbrokers trust funds and debt securities bonds. Indeed Sharīʿah permissibility of investing in the stock market is a result of relaxation of rules under the principle of necessity to remove hardship in business transactions. A Comparative Approach 2nd Edition looks at the similarities and differences between Islamic capital markets and conventional capital markets.

Islamic finance despite its name is not a religious product. And securitization issuance transactions and related enforceability issues are considered. Islamic capital market instruments and products are discussed in Islamic banking course and masters in Islamic banking and finance programs which leads to phd in Islamic banking.

Basically Islamic equity and Sukuk together made up the commodities being traded in the ICM. Islamic Fintech for the Capital Markets. A conventional market allows and in fact invites investors to.

The sale proceeds are distributed to the client net of the outstanding purchase price. It is more so in an Islamic economy because prohibition of interest implies greater reliance on equities and asset based financing. This is however not surprising given the progress posted by IFS in general terms.

Fintech financial technology is the application of disruptive technology to traditional financial services to achieve savings and optimise cost time and system efficiency. Islamic Capital Market The ICM is a component of the overall capital market in Malaysia It plays an important role in generating economic growth for the country. The development of Islamic capital markets is integral part of development of capital markets in general.

The ICM functions as a parallel market to the conventional capital market and plays a complementary role to the Islamic banking system in broadening andOccupation. Developments in Islamic finance have taken place to allow. Such markets are essential for efficient resource mobilization and allocation.

Islamic finance has emerged as an effective tool for financing development worldwide including in non-Muslim countries. Robo-advisory equity crowdfunding ECF peer-to-peer P2P lending.

Islamic Capital Market Principles Practices Hardback

Islamic Capital Market Saraycon

Islamic Capital Market Ppt Video Online Download

Islamic Capital Market Springerlink

Islamic Capital Markets A Comparative Approach Wiley

Posting Komentar untuk "What Is Islamic Capital Market"