Is Trading Income Taxable Uk

17 from 2010 however a partial exemption scheme may apply to new companies. Trading Essentials Technical Analysis Risk Management.

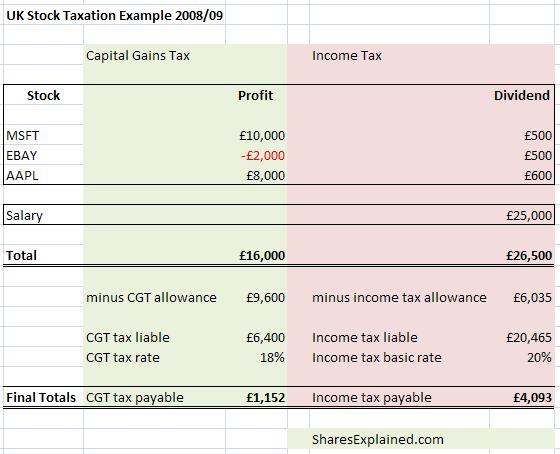

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

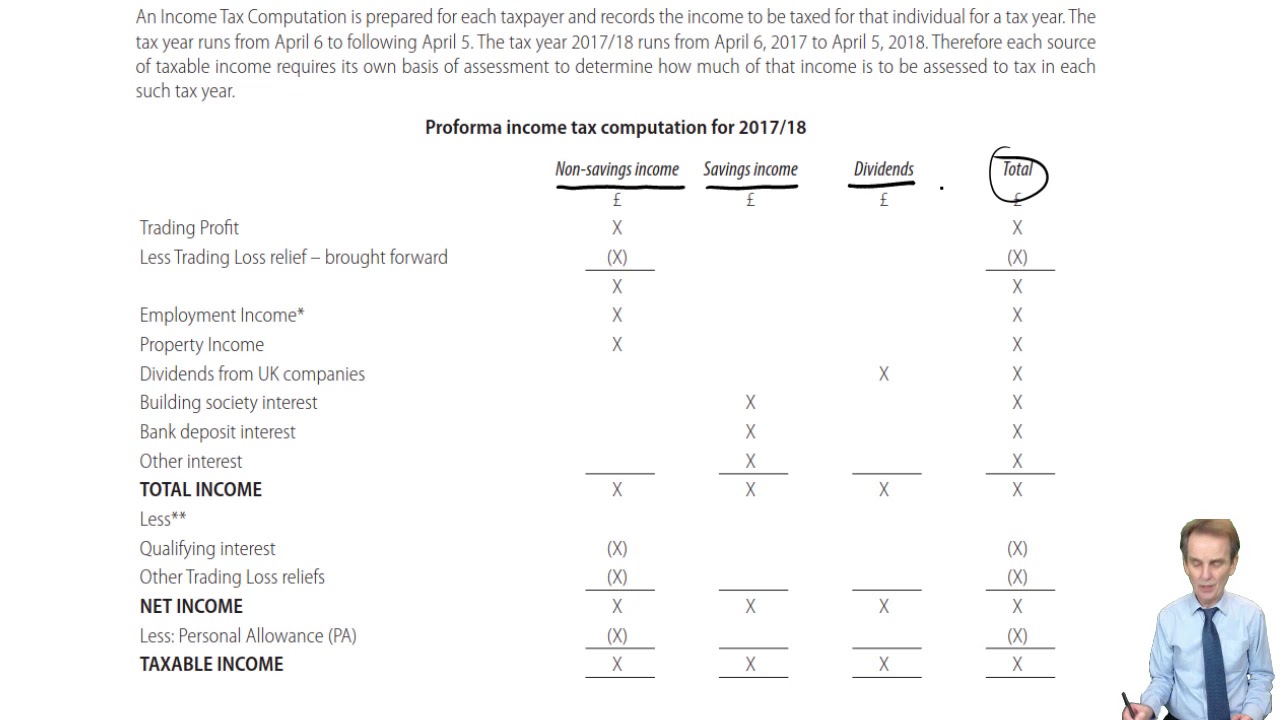

This can include trading income property income and miscellaneous income.

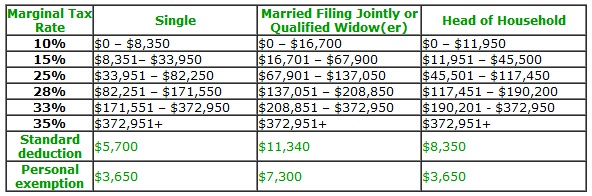

Is trading income taxable uk. Looking specifically at of the badges of trade we should also identify a one reason for the purchase and a reason for the salen the case of Taylor v Good. The Personal Income Tax Rates and Thresholds also contain details on specific allowances which apply to income and. Taxable income is the portion of your income on which you pay income tax.

Just 295 per UK trade 395 per US trade and 395 per European trade No annual fee for holding shares ETFs or bonds in your account. The foreign earned income exclusion excludes income earned and taxed in a foreign country from the US taxable income of American expats. Low-cost trading on shares and ETFs.

In the UK income tax is calculated using Personal Income tax Rates and Thresholds and they are published for each tax year by HMRC. If however youve already claimed part or all of your 1000 trading income allowance against self-employed income then its the unused amount if any that can be deducted to determine the. 125 on trading business income and 25 on non-trading income.

If you want to know whether different types of income are taxable or not we suggest you visit our page with more general information in the tax basics section. Taxable as trading income along with all of the other properties he had bought and sold. In tax terms some income is called taxable you have to pay tax on it and some is non-taxable not taxable exempt or tax-free you do not have to pay tax on it.

0 to 10 deductible in computing Federal taxable income. The form of the relief depends on whether the rent a room receipts exceed the. What is Taxable Income.

UK Income Tax Rates Allowances Reliefs 15 April 2020 PTC With the 201920 tax year coming to a close on 5th April 2020 and the new 202021 tax year beginning on 6th April 2020 we have put together this quick guide to help you understand the personal income tax rates allowances and reliefs that may be available to you.

Acca Taxation Tx Uk Income Tax Computation Introduction Youtube

Income Tax Computation Introduction Acca Taxation Tx Uk Fa2018 Youtube

Taxable Trading Income Under United Kingdom Uk Cambodia Tax Cambodia Accounting

Uk Cryptocurrency Tax Guide Cointracker

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

Posting Komentar untuk "Is Trading Income Taxable Uk"