How Much Saving To Retire In Malaysia

First 5 years Independent living at RM36000 a year. With an average savings of RM194000 assuming one lives until 75 with no major medical expenses or outstanding debt that amounts to about RM810 per month which is RM25 a week.

Retire In Malaysia 17 Ways To Stretch Your Retirement Fund

Estimate how much you can save with a regular savings plan eg.

How much saving to retire in malaysia. You have just enough to retire at for the next year s. How Much Should I Save To Retire By 62. Allocate at least 15 to 20 of your current income for retirement savings whether you are employed in public private sector or self-employed.

Cheng survives on a minimal RM700 per month. The rate is expected to trend around 350 in 2020. Monthly expenses are derived by inflating monthly contributions from current age until the day you want to cash in your savings plan.

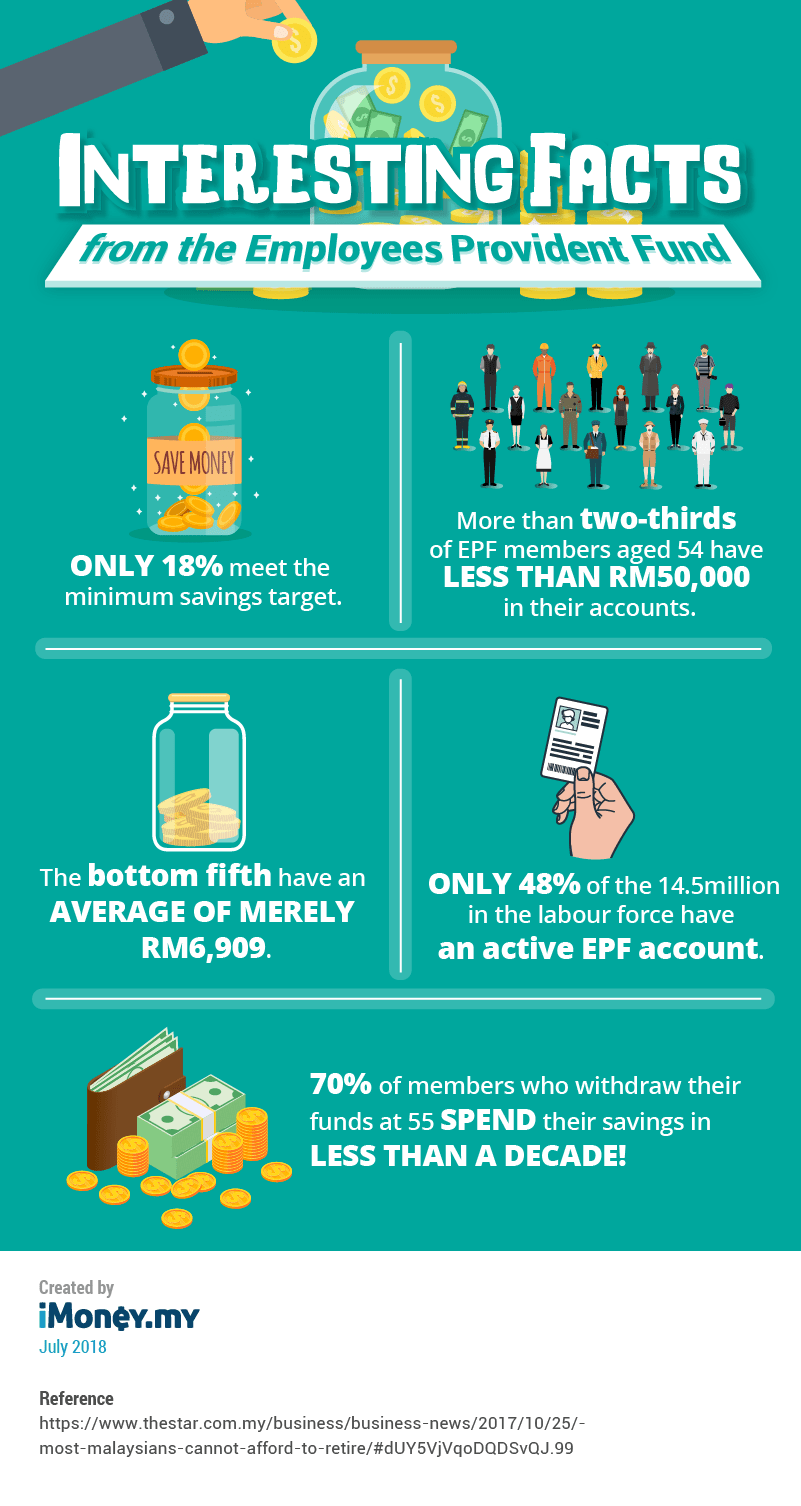

Unable to show your retirement goal result. Do diversify your investments. More than 80 of EPF contributors do not have the minimum savings target of around RM280000 by retirement age and the bottom 20 contributors have average savings of less than RM7000 Hawati says.

Malaysia only taxes income earned in Malaysia. If you have the government pension then the deposit wavers. If you do work in Malaysia you will be taxed up.

Assuming an average interest rate of 5 from your EPF you need to have at least RM14 million to RM3 million to get an annual interest of RM68000 to RM150000. World Bank data shows Malaysians not saving enough for pension three-quarters will have less than RM1050 monthly benefit at age 54 Tuesday 24 Nov 2020 0135 PM MYT BY SHAHRIN AIZAT NOORSHAHRIZAM. Return to top for this approach.

4 inflation is an estimation. Private Pension Administrator PPA CEO Datuk Steve Ong has earlier suggested that every Malaysian should save at least 33 of their monthly income for retirement savings. Now allow us to break it down for you.

Or at least a time where you should not have to keep working to cover your costs of living. Last year the Employees Provident Fund EPF raised the minimum savings target to RM228000 by the age of 55. This means a monthly retirement income of the only RM950 per month assuming a life expectancy of 75 years old.

In fact according to this list of pension savings recommendations our EPF should have more than RM 30k savings before the age of 30. We are at 33 at end of 2021 mostly due to the Pandemic Source. The average retirement age for Singaporeans is at age 62.

After deducting 11 from your monthly income and 12 employers contribution into your EPF account you will still need to save about 9 to 10 every month. Anyone over 50 years of age must deposit RM150000 34883 into a bank in Malaysia of your choice Citibank HSBC and Standard and Chartered seem the most popular or prove you have a monthly income of RM10000 2350 from a government pension. EPF recommends a minimum amount of RM228000 by the time youre 55 which gives RM950 in monthly expenditures over 20 years.

Apply the formula using the Retirement Savings Required from the table and number of years to retire from 2017 for the correct savings amount. By 2030 the rate would certainly be much higher and the higher the rate the lesser purchasing. If youre unfortunate enough to get hit with such a big loss during your retirement in Malaysia or even an extended period of weak gains especially early in retirement the chances of your retirement savings lasting 30 or more years with 4-plus-inflation withdrawals can drop like a.

RM240000 translates to RM1000 a month for 20 years in retirement. RM180000 Next 5 years Semi-independent living at RM37200 a year. For example if you are 30 years old you should be investing 80 110 - 30 of your savings.

Statistics show that two out of three Employees Provident Fund EPF members aged 54 have less than RM50000 in retirement savings. Therefore if you are only earning retirement income from a pension or Social Security you will not be required to pay taxes on your income. You have RM0 more than you need to retire comfortably at for the next year s.

Instead you should aim to save enough so much so that the annual interests earned on your capital alone is sufficient for you to sustain your lifestyle entirely. Assuming life expectancy of 75 years old heres a rough estimate of the total retirement savings that you need. While theres a minimum retirement savings estimate provided by EPF RM240000 it doesnt fully account for the economic realities of the average urban Malaysian today.

According to a recent report by The Star newspaper current EPF savings for most Malaysians are barely enough for a decent life after retirement. Given that the national average household expenditure stood at RM4534 a month in 2019 RM1000. Interest compounded based on selected period.

Malaysians can fully withdraw their retirement savings from the EPF at 55 but many people tend to exhaust their savings within three to five years after a full withdrawal. View the principle and total savings by year in the chart and table. Malaysia Retirement Savings Calculator.

To maintain your desired retirement lifestyle you will need to save per month from now The annual inflation rate is 3. Calculate the total amount earned from regular savings. But for many Malaysians this isnt the case.

Suppose that the monthly living expenses of average 60 years olds in Malaysia after retirement are conservatively estimated at RM 1000. If thats not shocking there are other alarming statistics reported last year. The rule of thumb is to invest at least 110 - your age of your savings.

Strive to supplement this with additional retirement savings of your own such as Private Retirement Schemes and from other investment assets.

How Much Do Malaysians Really Need For Retirement

How Much Do Malaysians Really Need For Retirement

What S The Magic Number How Much Do You Need To Retire The New Savvy

How Much Do Malaysians Really Need For Retirement

Sponsored Retirement In Malaysia Will You Fight Or Flight Ringgit Oh Ringgit

Posting Komentar untuk "How Much Saving To Retire In Malaysia"