Socso Contribution Table For Foreign Worker 2019

Socso Contribution Table. In Plain English Socso For Businesses In Malaysia The Vox Of Talenox.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

The Contribution Rate table can be.

Socso contribution table for foreign worker 2019. The employees themselves do not need to contribute to SOCSO. The employment income of an approved individual under the Returning Expert Programme will be taxed at the rate of 15 percent of that chargeable income. Socso Table 2019 For Payroll Malaysia Smart Touch Technology.

This is because Human Resource Minister M. Foreign Worker Socso Rate. There were 44659 active employers who hired 103 million active foreign workers in 2019.

Employees are not required to make a contribution. The Cabinets decision to place social security protection of foreign workers is in. Contribution Rates Contributions to the Employment Insurance System EIS are set at 04 of the employees assumed monthly salary.

According to The Star news report that Malaysian government has decided to place social security protection of foreign workers under Social Security Organisation Socso with effect from Jan 1 2019. In the first category for the most part the employer is to pay 175 of the employees total salary towards the fund and the employee is. In simple terms there are two categories of the SOCSO fund.

50 of employers were involved in service activities while the remaining 50 were involved in non-service activities. Employers are expected to contribute 125 of an employees monthly wage to SOCSO on a monthly basis subject to the insured wage ceiling of MYR 4000 per month. Both the rates of contribution are based on the total.

Socso for foreign workers from Jan 12019. When wages exceed RM50 but not RM70. Employee contribution rate is based on the employees wages overtime commissions service charge annual leave emoluments sick leave maternity leave public holidays incentives.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology. When wages exceed RM30 but not RM50. 02 will be paid by the employer while 02 will be deducted from the employees monthly salary.

Employees are not required to make a contribution. A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act. Foreign Employees Socso Follow Second Category Table Youtube.

The rate of employers contribution for this Category is 125 of the employees monthly wages capped at RM4940 for wages exceeding RM4000. Archive contribution employee socso. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme.

For foreign workers including expatriates only employers are required to contribute to SOCSO. Employers are required to contribute 125 percent of an employees monthly wages to SOCSO on a monthly basis subject to the insured wage ceiling of MYR 4000 per month and capped at MYR 4940. The contribution rate is 125 of the Insured monthly wages and to be paid by the employer.

For foreign workers including expatriates only employers are required to contribute to SOCSO. The contributions for a month are due by the 15th of the following month. Contribution Rate of EIS for Socso Table 2019 Malaysia Contributions to the Employment Insurance System EIS Socso Table 2019 are set at 04 of the employees assumed monthly salary.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology. When wages exceed RM70 but not RM100. Beginning Jan 1 2019 employers must make Socso contributions for their foreign workers and this involves the 18 million foreign workers that we.

Contribution rates are capped at an assumed monthly salary of RM400000. The contribution rate is 125 of the Insured monthly wages and to be paid by the employer. Kulasegaran said the existing act Workmens Compensation Act 1952 for foreign labourers is.

Employers hiring foreign workers were mandated to pay SOCSO contributions on behalf of their workers in 2019. Our government has come up with a great initiative as they have decided to ensure that foreign labourers and domestic maids are covered under Socso Social Security Organisation to protect their rights starting 2019. How To Pay Socso Perkeso Online.

Social Security Protection Of Foreign Workers Under Socso From Jan 1. Socso Table 2019 For Payroll Malaysia Smart Touch Technology. Contribution By Employer Only.

Socso Contribution For Foreign Worker 2019 Social Security Coverage Extended To Foreign Workers He Said The Scheme Would Not Only Benefit Foreign. Beginning on 1 January 2019 employers who hire foreign workers not including domestic servants shall register their employees with SOCSO and contribute to the Employment Injury under the Employees Social Security Act 1969 Act 4. For example January 2019 contribution is due by February 15 2019.

Employment Injury Scheme For Foreign Worker. There is often much confusion around the exact amount to be paid by the employer and employee towards the SOCSO fund. A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act.

Effective 1 January 2019 employers in Malaysia who hire foreign workers including expatriates with valid documents must register their employees under Social Security Organisation Socso and contribute to the Employment Injury Scheme EIS as reported by The Star Online. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme. SOCSO Contribution chart.

GAJI BULANAN JENIS KEDUA - BENCANA PEKERJAAN SAHAJA JUMLAH CARUMAN OLEH MAJIKAN SAHAJA 26. Wages up to RM30.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Social Protection For Foreign Worker

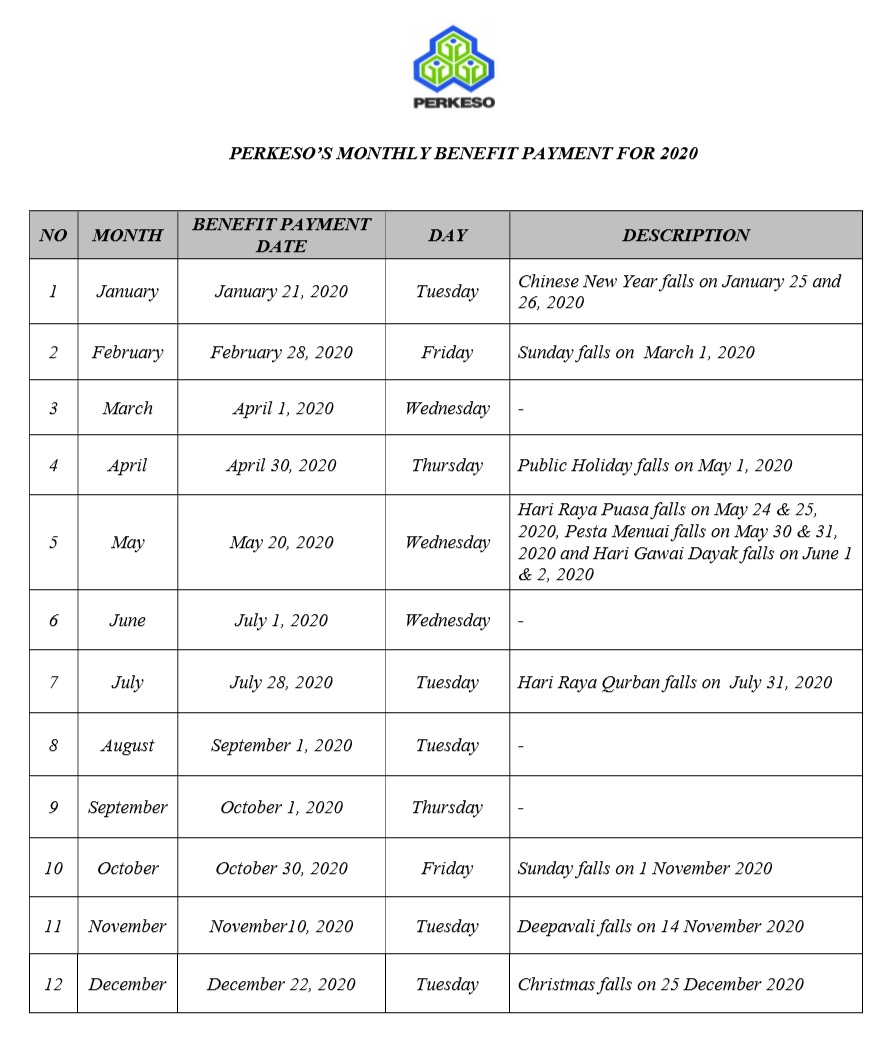

Socso S Monthly Benefit Payment

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Posting Komentar untuk "Socso Contribution Table For Foreign Worker 2019"