I-sinar Withdrawal Application

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. EPF says only confirmation of the maximum withdrawal amount is required during members online application for the i-Sinar scheme.

Need To Withdraw More Epf I Sinar Applications Can Now Be Amended Online Soyacincau

KUALA LUMPUR 5 Dis There are no conditions attached for i-Sinar withdrawal application and what is outlined are the criteria to ensure that the application matches the Employees Provident Funds EPF internal data.

I-sinar withdrawal application. You cant apply over-the-counter and do beware of any third-party apps that claim to offer i-Sinar submissions. Beware of potential scammers. The EPF had on a few occasions stated that there were no conditions attached for the i-Sinar withdrawal application and what have been outlined are loose criteria to ensure that the application.

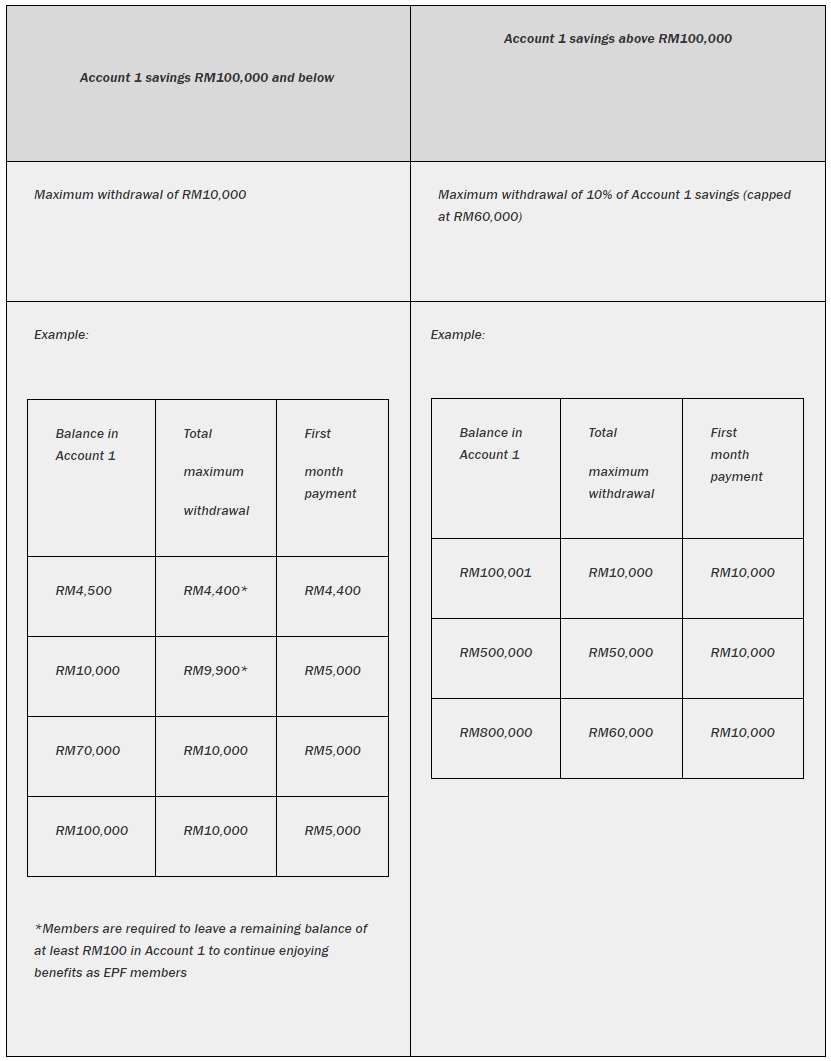

For those with RM100000 and below in Account 1 they can withdraw any amount up to RM10000. For members who fulfill the criteria their application will be approved automatically the EPF said. Category 1 members have been able to submit their applications since Dec 1 2020 while members under Category 2 can start applying today.

Need extra cash to cover your living expenses. There are no conditions attached for i-Sinar withdrawal application and what have been outlined are the criteria to ensure that the application matches the Employees Provident Fund. The EPF had on a few occasions stated that there were no conditions attached for the i-Sinar withdrawal application and what have been outlined are loose criteria to ensure that the application matches the EPFs internal dataThis withdrawal facility which is known as i-Lestari will be available starting 1st April 2020 and heres what you need to knowBut the I got.

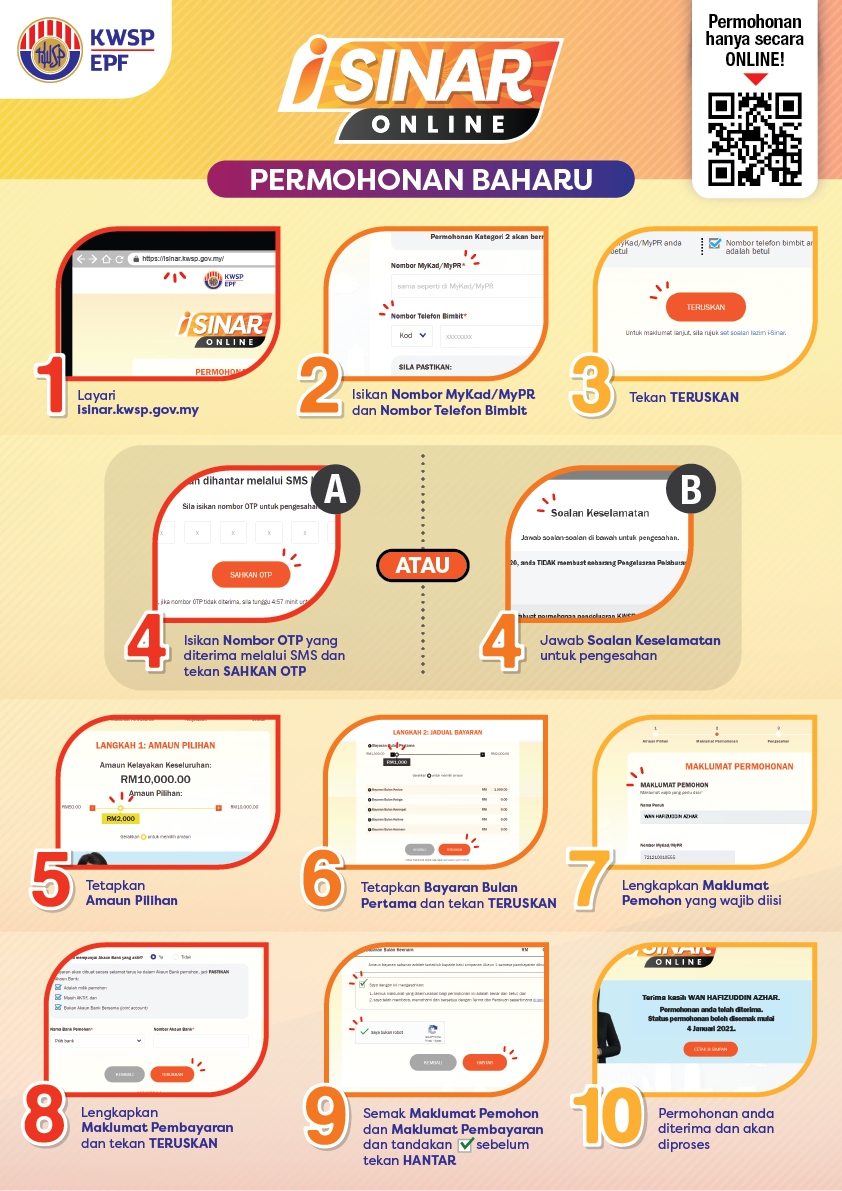

EPF CEO to bring proposal on abolishing TC for i-Sinar to Tengku Zafrul. The process of verification is required to avoid fraud and improper withdrawal of i-Sinar funds by third parties. Heres a quick step-by-step application guide.

It said only confirmation of the maximum amount is required during members online application which is not difficult. After that the contributions will return to the status quo. EPF members can only submit their i-Sinar applications online via the official portal at httpsisinarkwspgovmy.

I-Sinar to help them survive. In a statement issued today in response to media query the retirement fund. To log in the portal will need to.

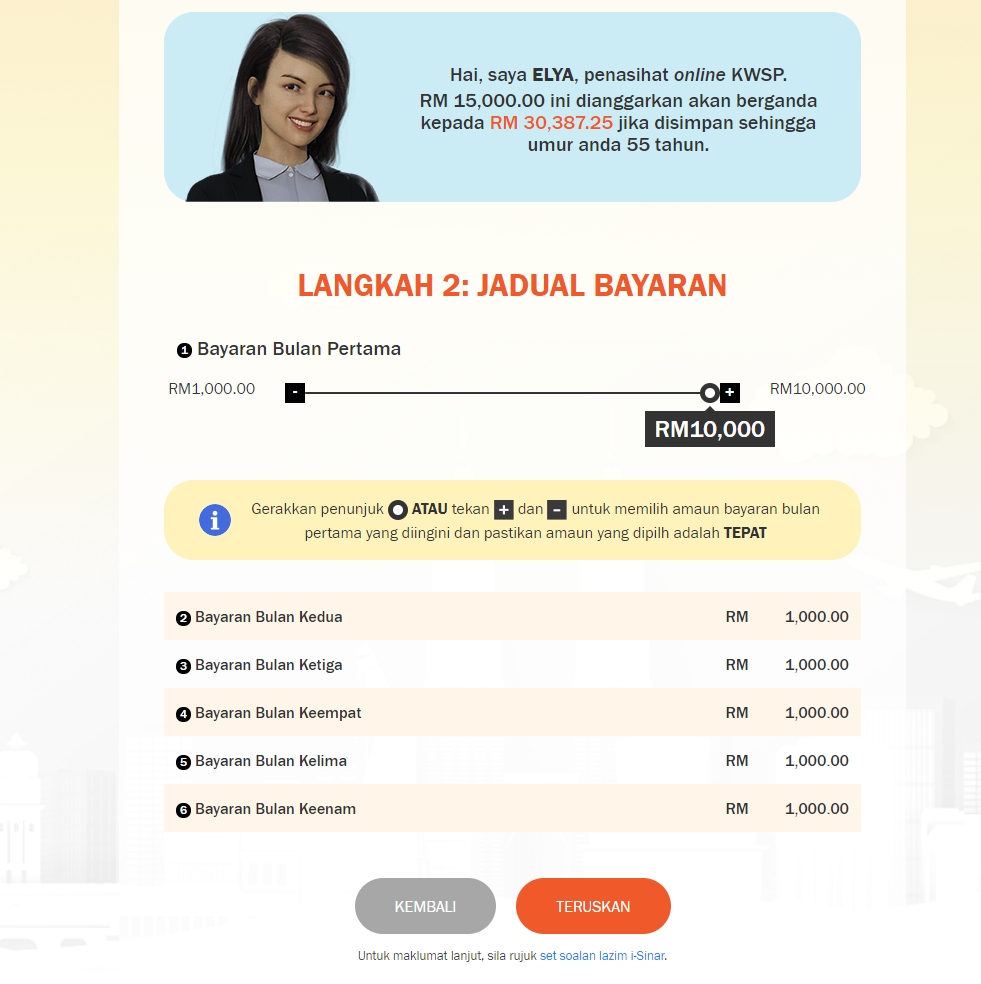

The amounts for withdrawal as well as the maximum six-month payment schedule of the amounts withdrawn are as previously communicated. KUALA LUMPUR Dec 6 There are no conditions attached for i-Sinar withdrawal application and what is outlined are the criteria to ensure that the application matches the Employees Provident Funds EPF internal data. 70 and 30 to Account 1 and Account 2 respectively.

In a statement issued today in response to a media query the retirement fund said this is to ensure it will easily and. The idea is that this will help those who have been impacted by the prolonged pandemic to make ends meet. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

To date EPF said a total of RM185 billion has been disbursed under the i-Sinar facility since the application opened in December 2020 benefiting 33 million members. Over two million Malaysians will be able to apply to withdraw funds from their Employees Provident Fund EPF Account 1 from next month under the EPF i-Sinar programme. The Employees Provident Fund EPF is allowing eligible members that are affected by the COVID-19 pandemic to withdraw up to RM60000 from Account 1 under the i-Sinar program.

Do not assume BN wants to topple the government Asyraf Wajdi 5 months of darkness may i-Sinar brighten up our lives. The i-Citra withdrawal was introduced following the announcement of the Pakej Perlindungan Rakyat dan Pemulihan Ekonomi Pemulih by Former Prime Minister Tan Sri Muhyiddin Yassin on 28 June 2021 as a. In a statement today it said eligible contributors are divided into two categories.

All EPF members can withdraw from Account 1. Bernama pic December 5 2020 KUALA LUMPUR The Employees Provident Fund EPF says there are no conditions attached to the i-Sinar withdrawal application saying that what is outlined is criteria to ensure that applications. KUALA LUMPUR Dec 2 The Employees Provident Fund EPF has announced the criteria and details regarding the i-Sinar withdrawal facility which has been further expanded to cover some eight million eligible contributors.

Also beginning 8 March 2021 members may amend their application details such as amount to be withdrawn bank details address telephone number and payment method on i-Sinar Online. The Employees Provident Fund EPF will consider every application for withdrawal under the second category of the i-Sinar facility. However it is important to note that this is not a withdrawal.

The eligible amount for i-Sinar is subject to the members Account 1 balance based on the latest details below. Possible scenarios for RM10000 withdrawal with balance of over RM100000 in Account 1 Where to apply. Reminder to members of the Employees Provident Fund EPF below age 55 years that i-Citra application submission is due this 30th September 2021.

These details include the withdrawal amount bank. In case you have any more inquiries you can contact the i-Sinar hotline at 03-8922 4848. Yes members who choose to apply for i-Sinar are required to channel 100 future EPF contributions into Account 1 until the amount withdrawn is replenished.

If you go to the i-Sinar portal youll be greeted with 4 options which include new application check application status amend withdrawal and cancel withdrawal. BN can still reject Budget 2021 if EPF withdrawal is complicated Najib. Chief executive officer Tunku Alizakri Raja Muhammad Alias said regardless of income amounts members who are financially affected but not eligible to apply for i-Sinar under the first category can apply for the facility under the.

Aside from reopening the submission for new i-Sinar applications the EPF is now also allowing members to amend certain details in their previous applications via i-Sinar Online. Payment will be done before the end of the following month after the application is approved. Through the Employees Provident Funds EPF i-Sinar facility members can withdraw up to RM60000 from their Account 1.

Epf I Sinar Applications Are Now Open Here S How To Apply Soyacincau

Epf I Sinar Applications Are Now Open Here S How To Apply Soyacincau

Need To Withdraw More Funds Epf I Sinar Applications Can Now Be Amended Online

I Sinar Category 2 How To Apply And Eligibility Comparehero

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Posting Komentar untuk "I-sinar Withdrawal Application"