Green Investment Tax Allowance

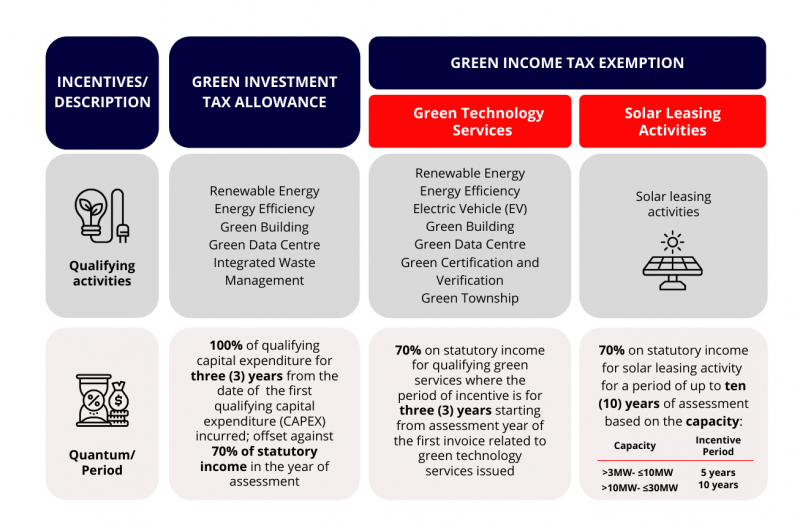

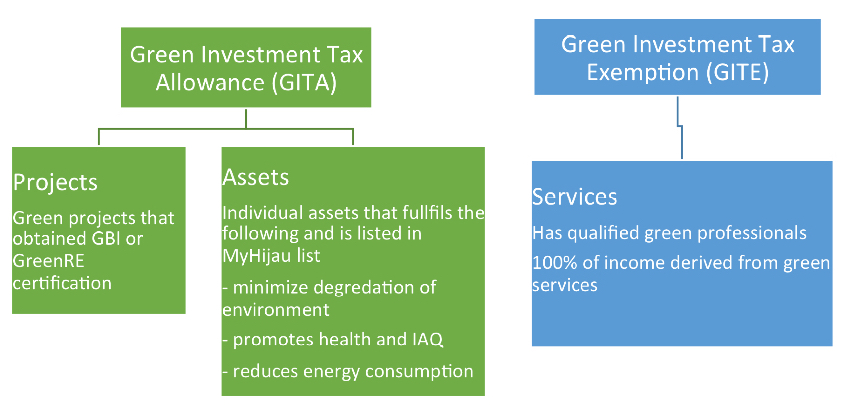

The Green Investment Tax Allowance GITA assets are for companies that obtained qualifying green technology assets. Tax incentive on Green Investment Tax Allowance GITA Assets Overview of GITA.

Green Technology Incentives Towards Achieving Sustainable Development In Malaysia Mida Malaysian Investment Development Authority

Advanced share investment tools.

Green investment tax allowance. With the implementation of the Construction Industry Transformation Map ITM the IAS will be extended to 2023 to provide continual support for. Ad A global leader in online investing. The allowance can be offset against 70 of statutory income in the year of assessment.

The Malaysian government currently offers a 100 tax incentive known as Green Investment Tax Allowance GITA and Green Investment Tax Exemption GITE to encourage the use of eco and green technology products. 1 Green Investment Tax Allowance GITA - Project 11 Green Investment Tax Allowance of 100 of qualifying capital expenditure incurred on green technology project for three 3 years from the date of first qualifying capital expenditure CAPEX incurred. To take advantage of this tax allowance companies should comply with.

Green Investment Tax Allowance GITA Assets Applicable for companies that acquire qualifying green technology assets and listed under MyHIJAU Directory. Malaysias renewable energy policies got a further boost in Budget 2020 with the Green Investment Tax Allowance GITA and Green Income Tax Exemption GITE receiving an extension. A Green Investment Tax Allowance GITA Assets.

And Green Income Tax Exemption GITE - Income tax exemption of 100 of Statutory Income for qualifying green activities for a. The Investment Allowance Scheme IAS provides tax relief for productive construction equipment. As a hybrid thermal heat recovery split unit air conditioning system SonneAire Coolbox Save is applicable for this incentive.

Green Investment Tax Allowance GITA Projects. Green Investment Tax Allowance GITA Project Applicable for companies that undertake qualifying green technology projects for business or own consumption. Instant approval with Myinfo.

Applicable for companies that undertake qualifying green technology projects for business or own consumption. Here is a quick glimpse of what is GITA. A company granted ITA is entitled to an allowance of 60 on its qualifying capital expenditure factory plant machinery or other equipment used for the approved project incurred within five years from the date the first qualifying capital expenditure is incurred.

Tax Ktp Ktp July 22 2021 Green Investment Tax Allowance Green Assets GITA Tax. Green Investment Tax Allowance - Asset incentive In line with the Budget 2020 proposal the Malaysian Green Technology and Climate Change Centre MGTC has extended the Green Investment Tax Allowance GITA - Asset incentive for the acquisition of qualifying assets listed under the MyHijau Directory to cover. It is an alternative to PS but comes in the form of additional relief of 60 of the qualifying capital expenditure QCE incurred to.

Investment Tax Allowance ITA Investment Tax Allowance ITA of 100 of qualifying capital expenditure incurred on green technology project for three 3 years from the date of first qualifying capital expenditure CAPEX incurred. B Green Investment Tax Allowance GITA Project. Low costs local service from our Singapore office.

Ad A global leader in online investing. Instant approval with Myinfo. 12 The date of first qualifying CAPEX shall not be earlier than the date of.

Green Investment Tax Allowance GITA - 100 Investment Tax Allowance on capital expenditure on qualifying green assets to set-off against 70 of Statutory Income for a period of 5 years restricted to year 2020. Green Investment Tax Allowance GITA of 100 of qualifying capital expenditure incurred on approved green technology assets from the date of purchase until 31 December 2020. That promotes sustainability and green environment Incentive Investment Tax Allowance ITA of 100 of qualifying capital expenditure QCE incurred from the date of application received by MIDA until 31 December 2020.

Applicable for qualifying green technology service provider companies that are listed under the MyHIJAU Directory. What You Need to Know About the Tax Incentive on Green Assets During This Pandemic. Basic understandings of GITA Assets.

What Are Green Investment Tax Allowance GITA Assets. Green Income Tax Exemption GITE Services. It aims to increase productivity in the construction industry by accelerating the pace of mechanisation.

Low costs local service from our Singapore office. The allowance can be offset against 70 of statutory income in the year of assessment. A rate of 2 on consideration received or receivable by Green Investment Tax Allowance GITA Assets b Green Investment Tax Allowance GITA Project c Green Income Tax Exemption GITE Services d Green Income Tax Exemption GITE Leasing Services Tax GST on c As applications for GITA Assets are to be submitted to the Malaysian Green.

Advanced share investment tools. The ITA can be utilised to offset against 70 of statutory income. In line with the above-mentioned proposals the updated Guidelines for Green Technology Tax Incentive GITA GITE were recently published on the MyHijau website to provide guidance on the following tax incentives.

General Like PS ITA is an incentive measure available only for promoted products or promoted activities. As an alternative to Pioneer Status a company may apply for Investment Tax Allowance ITA. As an initiative to encourage the buying and selling of green technologies the Government provides an Investment Tax Allowance ITA for purchasing green technology equipment assets and an Income Tax Exemption ITE for providing green technology services.

In Budget 2020 to further promote the use of green technology the Government had extended the list of green assets from 9 assets to 40 assets. Tax incentive on Green Investment Tax Allowance GITA Assets.

The Green Investment Tax Allowance Gita Maqo

The Green Investment Tax Allowance Gita Maqo

Green Building Tax Incentive Explained

How Does The Green Investment Tax Allowance Gita Work Solarvest

How Does The Green Investment Tax Allowance Gita Work Solarvest

Posting Komentar untuk "Green Investment Tax Allowance"