At What Age Can I Withdraw My Epf

This form entails the member who is less than 58 years of age for receiving a scheme certificate for retention of membership. Withdraw via i-Akaun plan ahead for your retirement.

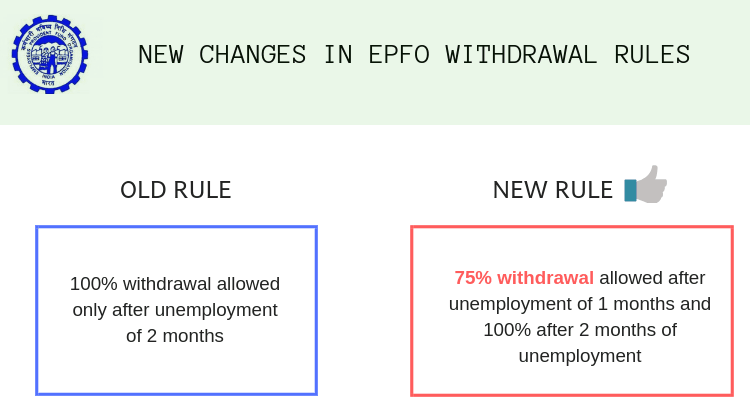

75 Of Epf Can Be Withdrawn Just After A Month Of Unemployment

Latest news related EPF withdrawal.

At what age can i withdraw my epf. Also if a person is unemployed for more than two months they can also withdraw their entire contribution and interest accrued on it. Is it still mandatory for members to link Aadhaar with EPF to avail online services. Procedure for EPF withdrawal.

The Umang app is a unified app that can be used to access a variety of pan-India e-government services including income tax filing Aadhaar and provident fund queries gas cylinder booking and Passport Seva. A person can withdraw 75 of his or her provident fund if heshe is unemployed for more than a month. Any member of the EPFO employed in an organisation affected by the epidemic or pandemic can make an application to the Commissioner seeking an advance from their EPF account.

Your Age EPS Contribution Form Instructions Less than 50 years Less than 10 Years 10C WithdrawalScheme Certificate. Grant of Advances in special cases. Mr Z can withdraw Rs 75000 as non-refundable advance from his EPF account.

Yes you can withdraw 75 of your EPF corpus after one month of unemployment. You can withdraw EPF amount for a similar reason for maximum 3 times. How to Withdraw EPF Online.

Regarding EPS contribution the form that one can fill are given in table below. This form is used to contribute to Life Insurance Policy from your provident fund account. For unemployment of more than 2 months the remaining 25 of the corpus can be withdrawn.

Our article EPF Partial Withdrawal or Advance. Under the second withdrawal the members are allowed to withdraw an amount equal to three months of basic salary and dearness allowance DA or 75 per cent of the credit. Withdrawal from EPF account Before you begin to withdraw you should note that the complete amount can be withdrawn when you have retired or have been unemployed for more than two months.

Quality education is the key to a stable career that will result in a comfortable life for you and your family. Withdrawal from the fund for repayment of loans in some special cases. In case you remain unemployed for 2 consecutive months you can withdraw the remaining 25 of the fund.

So 1 month after leaving the job You can withdraw up to 75 from your EPF account And after two months the remaining 25 amount can also be recovered In this way friends have many other conditions In which you can withdraw the total money of your puff account. It involves transferring your pension savings into a defined contribution pension after which you can withdraw all of your money using the pension freedoms. Further on May 31 2021 the government announced that an EPF member can make a second non-refundable withdrawal from their EPF accounts due to the Covid-19 pandemic.

The employee can withdraw the number of EPS even if they have not completed 10 years of service. I am currently unemployed and need funds. An EPFO member can withdraw up to 90 per cent of his EPF amount at any time after attainment of the age of 54 years or within one year before his actual retirement on superannuation.

There are some other partial withdrawal rules also. EPF Contributions To Be Deducted at 24 from August 1 2020. I resigned my job in September 2017 and my last contribution to EPFO Employees Provident Fund Organisation was in August 2017 at the age of 50 years.

Wherein nominee can fill the death claim through online at the easiest way. Early Retirement Once you reach 57 years of age you can opt for early retirement and withdraw up to 90 of the balance including the interest. 10-year services Pension Certificate for availing the pension at the age of 58 Years.

Interest earned on EPF is the equivalent of a high pre-tax rate. If an EPF member dies then the nominee such as wife or minor children will receive the monthly. Usually one can withdraw the EPF amount on or after their 58th birthday or on retirement.

10D For Monthly Pension benefit after 50 years of monthly Widow Pension children pension and Orphan Pension etc. You can choose to withdraw your savings from Account 2 to help finance your own children spouse andor parents education at approved institutions locally or abroad. This form is useful to withdraw fund at the time of retirement or quitting the job.

Following is mentioned the online process for EPF withdrawal. To withdraw this monthly pension amount you need to submit a form called form 10 D. In the EPF fund the employee can to withdraw the accumulated amount 2 months after hisher resignation.

A new webpage will open where you need to provide the correct bank. Considering that the EPF is paying 875 this year this is the equivalent of a 1250 rate of interest for somebody in the 30 tax bracket. How to Fill EPF Death claim filing by beneficiary Form 10D 20 and 5IF Application One can easily fill the EPF death claim through online you can visit the official portal and you can clearly see the option highlighted death claim filling by beneficiary.

EPF withdrawal before 9 Years and 5 Months IE. However if an individual is in service and has not completed 10 years then heshe cannot withdraw the EPS amount. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50.

This also applies to some people who have a public sector final salary pension. But none of the above cases apply to you you are still in a job but are relocating out of India. People with a private defined benefit or final salary pension can cash in their savings.

Can I withdraw my EPF corpus. But if you retire at age 55 youd be able to withdraw 90 of the EPF by age 54. The withdrawal can be made either by.

The Umang app is one of the routes an Employees Provident Fund member can take to withdraw money from their PF accountEPF can be withdrawn in part or in. Select Claim Form-19 31 10C 10D from the Online Services tab. The employee can use this post-retirement.

EPS amount can only be withdrawn if the individual quits the company before joining the new company. If an employee wishes to resign from his work for any reason whatsoever he may withdraw the remaining EPF balances. Step 2 is to check whether the KYC.

Can I withdraw EPS after 10 years. Sign in to your account with a password UAN and Captcha code. Visit the Member e-Sewa portal on the EPFO portal.

Process Form How much explains how you can partially withdraw from you EPF while in service for repaying the housing loan Marriage Treatment subject to prescribed conditions Steps to do EPF Withdrawal online Step 1 is to log on to the UAN portal and enter your login details. After submitting this form you will receive your monthly pension. This interest rate is guaranteed and risk-free.

The employer also contributes towards the employees pension fund along with EPF. EPF Withdrawal Rules Employees Provident Fund is an investment scheme created for the purpose of retirement. Two common questions about EPF withdrawal Can I withdraw my EPF money.

People who have more than 30000 in their final salary. Now you can submit the monthly pension withdrawal form 10D online also at the UAN member portal. This means that if you retire at age 58 youd be able to withdraw 90 by age 57.

You can withdraw EPF both the employee and employer contribution by submitting Form 19.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Posting Komentar untuk "At What Age Can I Withdraw My Epf"