Housing Market Malaysia 2020

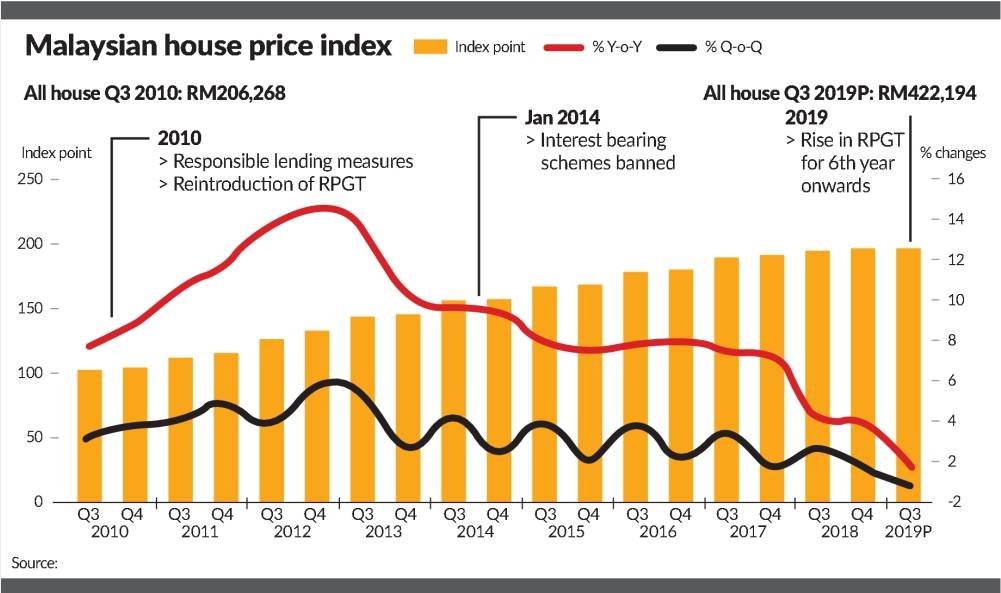

The central bank said house prices in the residential property segment as measured by the Malaysian House Price Index MHPI continued to. According to the PropertyGuru Market Index PMI Q3 2019 asking prices for properties across the board declined in three out of four major markets in Malaysia namely Kuala Lumpur Selangor and Penang.

08- 19- 2021 0440 PM.

Housing market malaysia 2020. The Malaysian property market had a good run in 2019 due to the Home Ownership Campaign HOC facilitating a good spillover effect at the beginning of 2020 according to the Malaysian chapter of the International Real Estate Federation FIABCI. The data was collected from January 1 2021 to December 31 2021 based on the 2021 user. In the first half of 2021 MHPI growth moderated to -03 2H 2020.

Doors in compliance with a movement restriction order MCO the tourism industry is hard. From 2009 to 2018 this volatility spread to other property classes such as detached and semi-detached homes. However the housing market finally lost steam beginning 2019 as the governments market cooling measures took effect.

To turn property development into a rent-seeking mechanism the government began to intervene housing policies and market-oriented practices. The Valuation and Property Services department JPPH shows similar data and an increase of merely 040 in its Malaysian House Price Index during the same time. Affordability was aggravated by the property hype during the 2010-to-2014 period when property prices rose double digits annually and peaked at 132 in 2012.

Price trends and projections for 2020. COVID-19 is disrupting the. Housing Index in Malaysia increased to 080 percent in the fourth quarter of 2021 from -070 percent in the third quarter of 2021.

Malaysias property market remains soft in 2020 sees better outlook on affordable housing in 1H 2021 Thursday 10 Dec 2020 1017 AM MYT According to the National Property Information Centre NAPIC the property markets performance recorded a sharp decline in the first half 1H of 2020. Five challenges faced by the property market in 2020. Housing is increasingly being regularised towards a new geography of profits and politics in Asia Chen Shin 2019.

Housing Index in Malaysia averaged 396 percent from 1997 until 2021 reaching an all time high of 4450 percent in the first quarter of 2000 and a record low of -3920 percent in the third quarter of 1998. KUALA LUMPURHousing market activities fell in the first half of 2020 1H2020 while non-residential properties experienced above-average vacancy rates and depressed rental yields Bank Negara Malaysia BNM said. 74 of the total unsold residential units were in the price category of above RM300000.

By state Johor has the highest number of. The Housing Market in Malaysia and the COVID-19 Pandemic. BNM said fewer housing projects launched during the second quarter further dampened market activity with the number of new units amounting to only about one-fifth 3911 units of.

Tan said prices of primary properties could go down between 10 and 15 and about 15 to 20 in the secondary market. Containing the spread of the new highly contagious Covid-19 virus remains a huge challenge. In terms of property types high rises exhibited the most volatility in prices from 1999-2009 from a high of 151 per cent growth in 2003 to a low of 59 per cent the previous year see Chart B.

Real Estate and Housing Developers Association Rehda Johor branch committee. June 4 2020 859. From 2016 to 2018 nationwide house prices rose by an annual average of 52 33 inflation-adjusted.

COVID-19 and housing affordability remaining as a huge challenge for Malaysia. This is more than twice the average unsold units from 2004 to 2015 71472 units. In its H1 2020 report NAPIC revealed that Malaysias residential overhang climbed up 33 to 31661 unsold completed units worth RM2003 billion during the first half of 2020 from 30664 units valued at RM1882 billion over the same period last year.

More than half of the current overhang stock is made up of condominiums and apartments. House prices in Malaysia continue to rise albeit at a slower pace following anti-speculation measures. Besides Malaysia is still a safe place to stay and the weak ringgit makes our property attractive to foreign buyers he adds.

The affordable house based on the latest criterion of the government is priced below RM300000 and make up 9937 units of the total overhang at 30664 at 2019 in Malaysia as stated in Table 3. Between 2010 and 2019 the average y-o-y increase in house prices of 79 surpassed incomes 56 he notes. Its president Michael Geh said the property sector entered 2020 on the tail end of the HOC and was.

MOST Malaysians cannot afford local housing anymore which is. He also added that it is likely that house prices in Malaysia will drop for the first time since 1999. The great divide in Malaysias housing market.

This was driven by the decline in prices across all types of properties during the quarter except for terraced house which recorded a small positive growth of 09. There is now one home for every 54 people compared with the average household size of 41 although the statistics are skewed by foreign workers being densely packed in rented homes or hostels. This page provides - Malaysia House Price Index.

In the first quarter of 2014 Malaysias nationwide house prices rose by 8 435 inflation-adjusted from the same period last year to MYR276668 US86027 the lowest year-on-year growth since Q4 2010 based on figures from the Valuation and Property Services. According to the PropertyGuru Malaysia Property Market Index the market saw a small gain of 038 in asking prices during Q2 2020 compared to the year before. The average annual appreciation for the 2012-to-2014 period was.

All in Malaysia had a total supply of 602 million homes in 2019 comprising 573 million houses 38134 SoHo units and 253056 serviced apartments. There are 3745 residential units priced below RM200000 per unit which remained unsold in the market in 2019. Perhaps the clearest indicator of market sentiment is seen in pricing movements moving into 2020.

Uncertainty of virus containment. From 2005 to 2015 Malaysias house prices rose by 961 524 inflation-adjusted. While it is still too early to predict the quantum and economic costs brought by COVID-19 on the property market the transaction volume and value of property will inevitably decrease in the first half of 2020 explained Dr Foo.

All eyes are on the economy and the housing market right now. Since 1999 terrace homes have shown. As at 2Q 2021 total unsold residential properties stood at 181460 units 1Q 2021.

Businesses in non-essential sectors have been forced to temporarily close their. Market activity weakened considerably with both volume and value of transactions falling sharply during the period it said in its Financial Stability Review First Half 2020 released today.

Investment Analysis Of Malaysian Real Estate Market

Covid 19 Politics And House Prices The Star

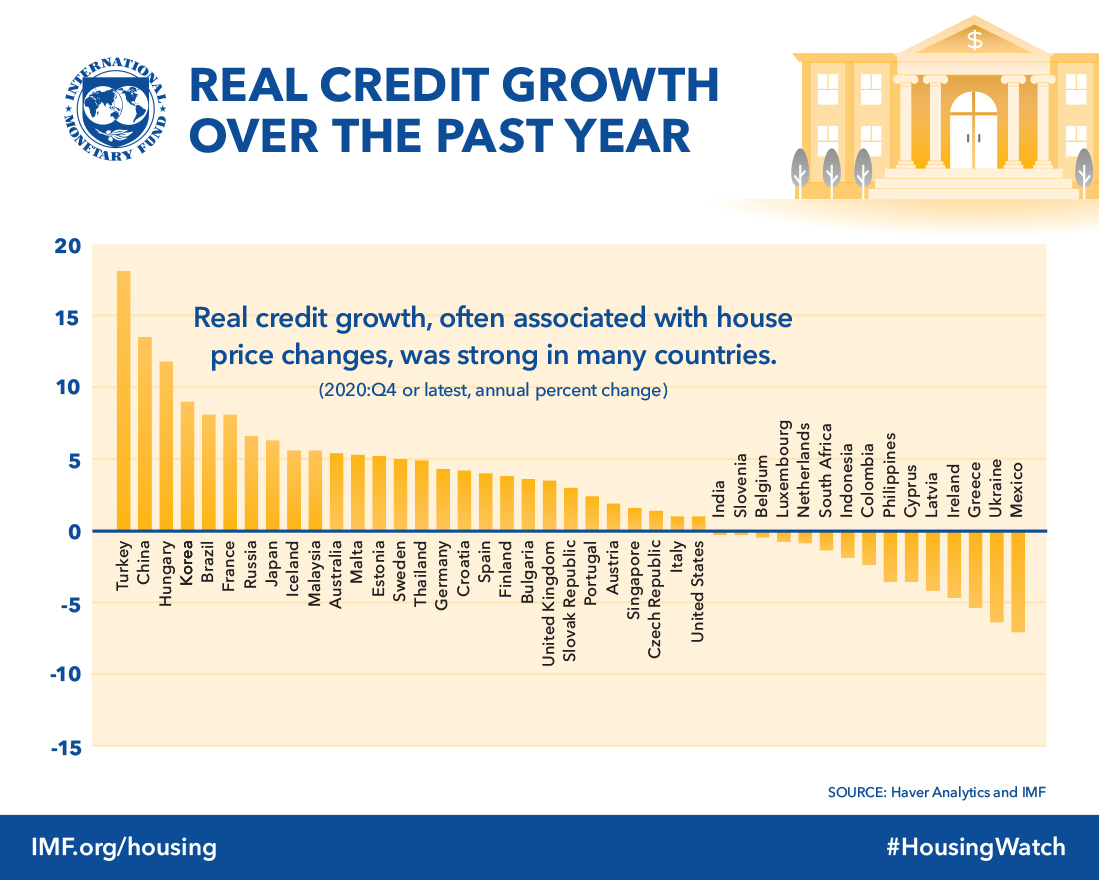

Housing Prices Continue To Soar In Many Countries Around The World Imf Blog

Housing Prices Continue To Soar In Many Countries Around The World Imf Blog

Posting Komentar untuk "Housing Market Malaysia 2020"