Epf Contribution For Age Above 60 2022

With effect from 1 January 2022 the contribution rates to the Central Provident Fund CPF for employees aged above 55 to 70 have been increased to. Higher Epf Contribution On Basic Allowances Calculate Extra Epf.

27 January 2022.

Epf contribution for age above 60 2022. Please click here to find out how. The 12 contribution made by the employer is split in the below-mentioned ways. Each contribution is to be rounded to nearest rupee.

The employer and employee contribute 12 of the employees basic salary and DA towards the EPF scheme. The provident fund further clarified that the reduced statutory contribution rate of 9 will only affect employees below 60 years of age. Budget 2021 Epf Employee Contribution Rate Set At 9 Starting January 2021.

Ad PGIM Defined Contribution Helps With Retirement Ready Solutions. The Employees Provident Fund EPF yesterday announced that employers will from now make a minimum statutory contribution of four per cent for. Contributions of the Second Category.

EPF announces that the minimum Employers share of EPF statutory contribution rate for. The minimum employers share. Employees age years CPF Contribution Rates changes from 1 Jan 2022 monthly wages 750 Total of wage By employer of wage By employee of wage 55.

Below are the minimum rates of contribution. The minimum statutory contribution by employers to Malaysias Employees Provident Fund EPF for employees aged above 60 will be reduced to 4 per month down. The minimum employers share of the Employees Provident Fund EPF statutory contribution rate for employees aged 60 and above has been.

The minimum Employers share of EPF. Is there any restriction in contribution to PF for a person who is in full-time employment and aged above 60. Employees age years CPF contribution rates changes from 1 January 2022monthly wages 750 Total of wage By employer of wage By employee of.

KUALA LUMPUR 7 January 2019. Example for each employee. KUALA LUMPUR Jan 7.

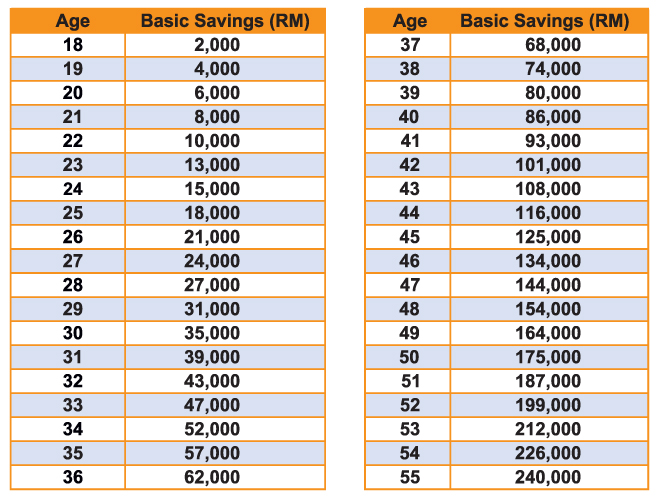

The Employees Provident Fund. Epf Contribution Table For Age Above 60. Effective from January 2018 the employees monthly statutory contribution rates will be reverted from the current 8 to the original 11 for employees below the age of 60.

Please note effective from January 2021 wages February 2021 contribution. Permanent Residents PR Non-Malaysians registered as member before 1 August 1998 No limit Applicable for i. Helping Provide Insights Into Participant Behavior To Provide An Appropriate Plan Design.

Cumulative statutory contribution rate of 24 13 employers share and 11 employees share for employees earning a monthly salary wage of RM500000 and below. Contribution to be paid on up to maximum wage ceiling of 15000- even if PF is paid on higher wages. Prableen BajpaiFounder FinFix Research Analytics.

You may opt to contribute more. Below 60 years old Stage 2 Age 60 and above Malaysian. The Employees Provident Fund EPF has reduced the statutory contribution rate for employees above age 60 who are liable to contribute.

The rate for those aged 60 and above will. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12. The rate of contribution under this category is 125 of employees monthly wages payable by the employer based on the contribution schedule.

The group released its report a day after Prime Minister Lee Hsien Loong said at the National Day Rally on Sunday that CPF contribution rates for older workers will be raised.

Employers Minimum Epf Contribution For Staff Aged 60 And Above Cut To 4 I Visit I Read I Learn

Employer Contribution Of Epf Socso And Eis In Malaysia

Epf Contribution For Employee Age Above 60 Blog

Epf Contribution At 11 Causes Confusion For Employers Here S A Quick Guide

Employers Minimum Epf Contribution For Staff Aged 60 And Above Cut To 4 I Visit I Read I Learn

Posting Komentar untuk "Epf Contribution For Age Above 60 2022"